- XRP saw its lower timeframe market structure and momentum flip bearishly

- Despite the strong selling pressure, there is a chance of recovery

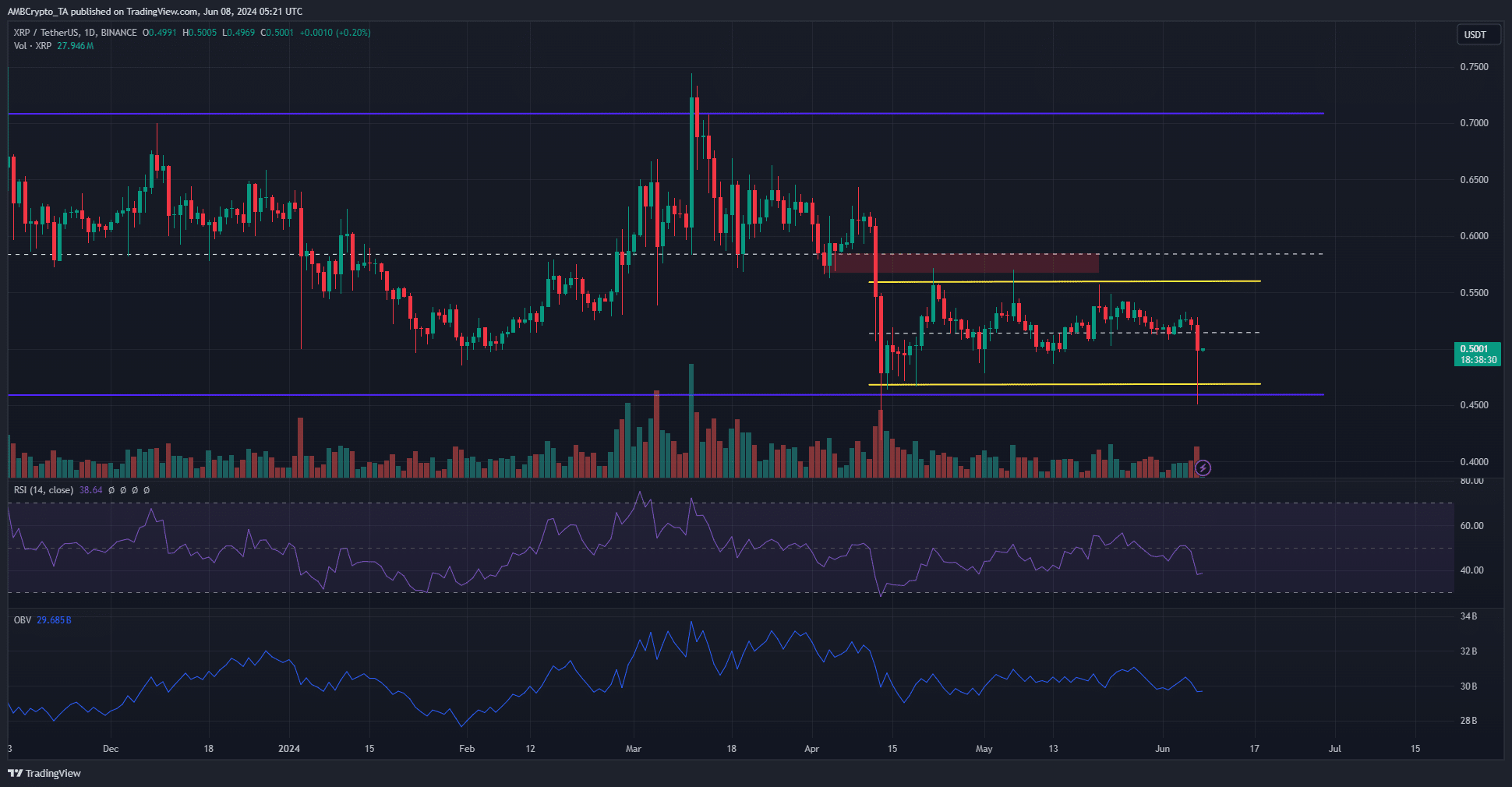

XRP has been rangebound over the last ten months. It formed a smaller range over the past two months and did not show signs of breaking out of this range at press time. In fact, the technical indicators suggested that a price bounce from $0.514 might happen.

Alas, this did not come to pass. XRP fell by 14.6% on 7 June, and it did so after bouncing by 10% from its lows, signaling a news-driven impulse move. What can traders expect from the altcoin next?

Lower timeframe mid-range was lost

The two-month range (yellow) extended from $0.47 to $0.56. The mid-range level at $0.514 served as support earlier this week, but Friday’s Bitcoin [BTC] crash dragged XRP down. This flipped the lower timeframe structure bearishly.

The OBV has been on a downtrend since April. It tried to recover in May, but over the past ten days set lower lows. This revealed that even though XRP was above the short-term range’s mid-level, buying pressure remained weak.

The RSI on the daily chart was also below neutral 50, signaling a downtrend in progress. This, combined with the loss of the psychological $0.5 zone, could see XRP drop as low as $0.45.

Assessing the chances of another sharp drop

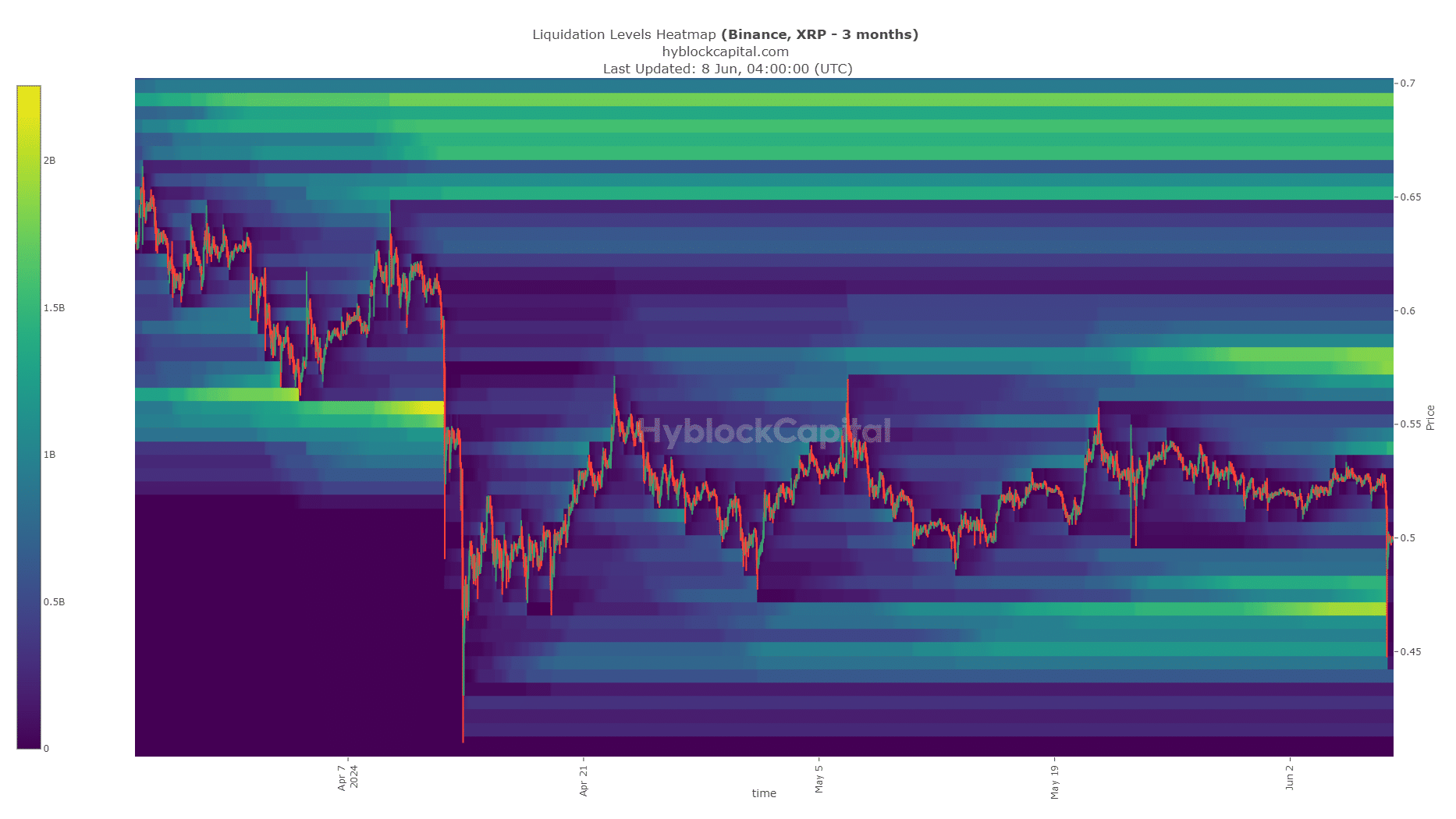

Source: Hyblock

The price action chart and the technical indicators signalled bearishness. On the other hand, the liquidations chart revealed that traders might want to counter-trade the downtrend. The liquidity pockets down to $0.45 have been swept too.

The next large cluster of liquidity lies at $0.58, which is the mid-range level of the 10-month range. Therefore, though it would be counterintuitive, it seemed likely that XRP might surge towards $0.58 in June before another rejection.