Solana’s performance in the DeFi and the NFT ecosystems was remarkable in Q2, but Q3 began with a few setbacks.

- Solana’s TVL increased by more than 1000% YoY in Q2.

- SOL was up by over 3% in the last 24 hours.

We have concluded the first week of the third quarter and Q2 performance of several coins like Solana [SOL] have arrived. The newly published report mentioned the blockchain’s performance on several fronts during the last quarter. Let’s have a look at how SOL did.

Solana’s Q2 performance

Coin98 Analytics posted a tweet mentioning Solana’s performance on many fronts. To begin with, the report mentioned that Solana’s fees and revenue experienced significant growth in the second quarter, generating over $26 million.

This was commendable as it’s a 42 fold year-on-year growth. The total SOL trading volume reached $292 billion, nearly 7 times higher compared to the same period last year.

Apart from that, Solana executed more than 15.3 billion transactions. Its daily active addresses were over 900k, which was a 499% YoY increase.

The sector where SOL’s performance was extraordinary was the DeFi space.

As per the report SOL’s TVL increased by more than 1000% YoY. Additionally, over 98 million new NFTs were created, a 54x increase YoY.

In Q2 2024, Solana’s unique NFT buyers and sellers stood at 1.4 million, and 678k, respectively.

SOL’s state in Q3

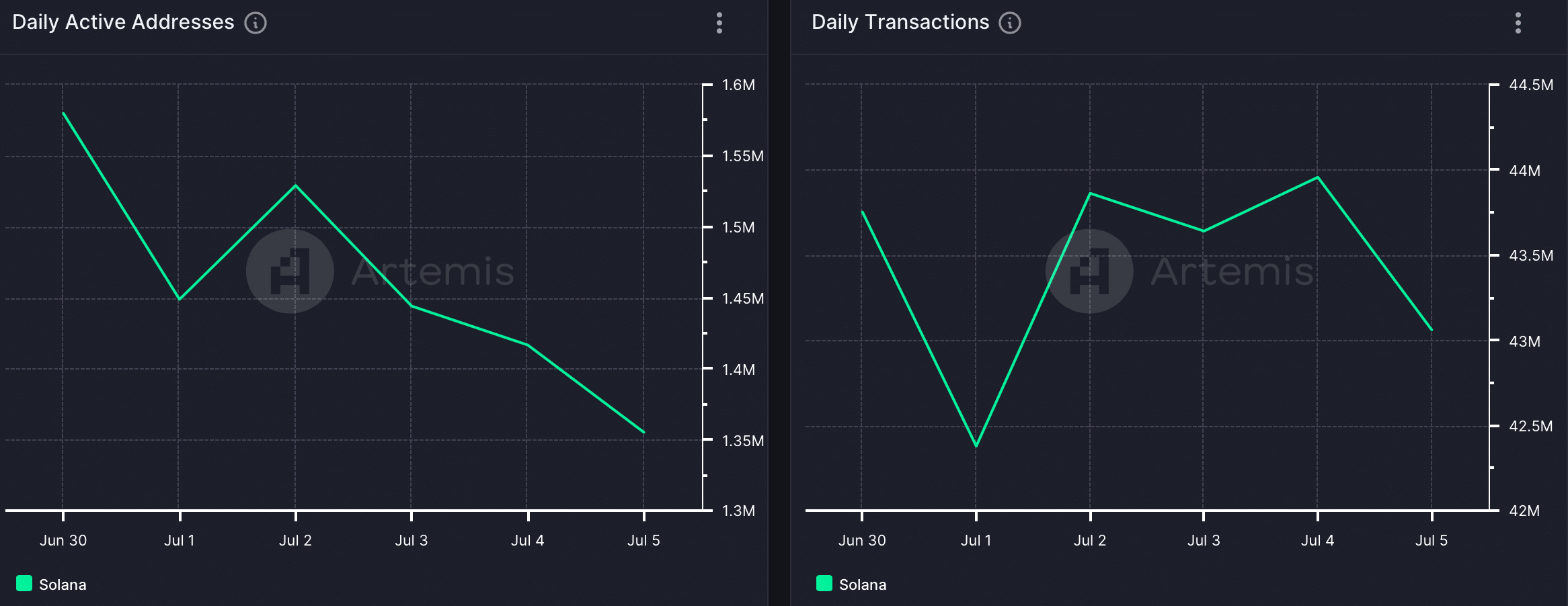

Now, let’s have a look at Artemis’ data to find out how SOL has been doing during the first week of this fresh quarter.

Unlike Q2, the third quarter didn’t begin on a good note as a few key stats fell. For instance, SOL’s daily active addresses declined sharply last week. Thanks to that, the blockchain’s daily transactions also fell.

A similar declining trend is also seen in terms of the blockchain’s fees and revenue. Nonetheless, SOL’s performance in the DeFi space remained promising as its TVL continued to rise over the last week.

SOL’s price is on par

After a few days of decline last week, the token’s price once again gained bullish momentum.

According to CoinMarketCap, SOL’s price increased by more than 3% in the last seven days. At the time of writing, SOL was trading at $140.57 with a market capitalization of over $65 billion, making it the 5th largest crypto.

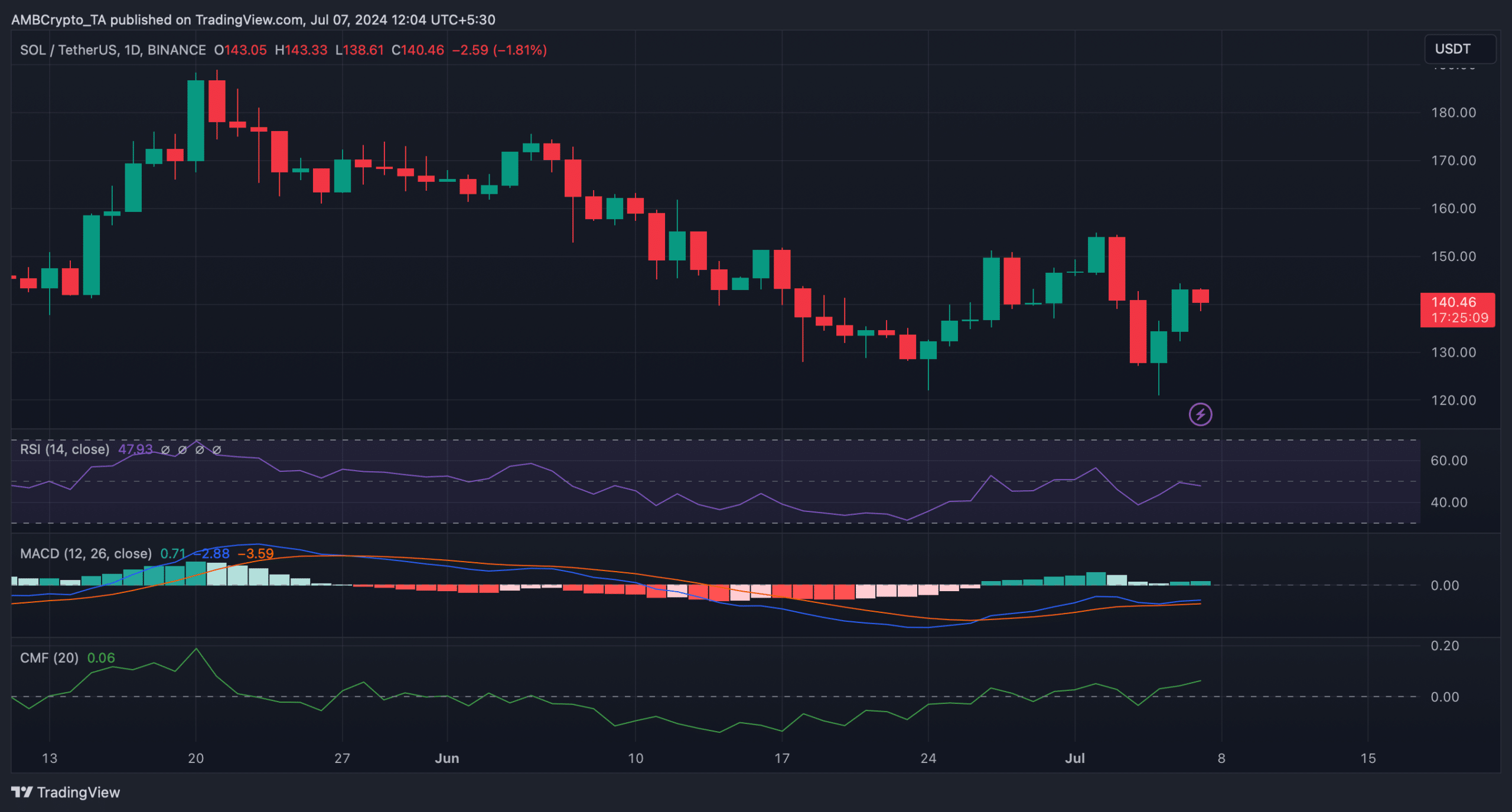

AMBCrypto then checked Solana’s daily chart to better understand whether this bull rally would sustain itself.

The technical indicator MACD displayed a slight bullish upper hand in the market. SOL’s Chaikin Money Flow (CMF) registered an uptick, which suggested that the chances of a continued price rise were high.

Nonetheless, the Relative Strength Index (RSI) looked bearish as it went southward.