ETH’s price action has been in the middle of a lot of volatility lately.

- Both longs and shorts experienced a turbulent time after ETH’s price went up and down

- Realized Profits increased, indicating that the value may fall below $3,400

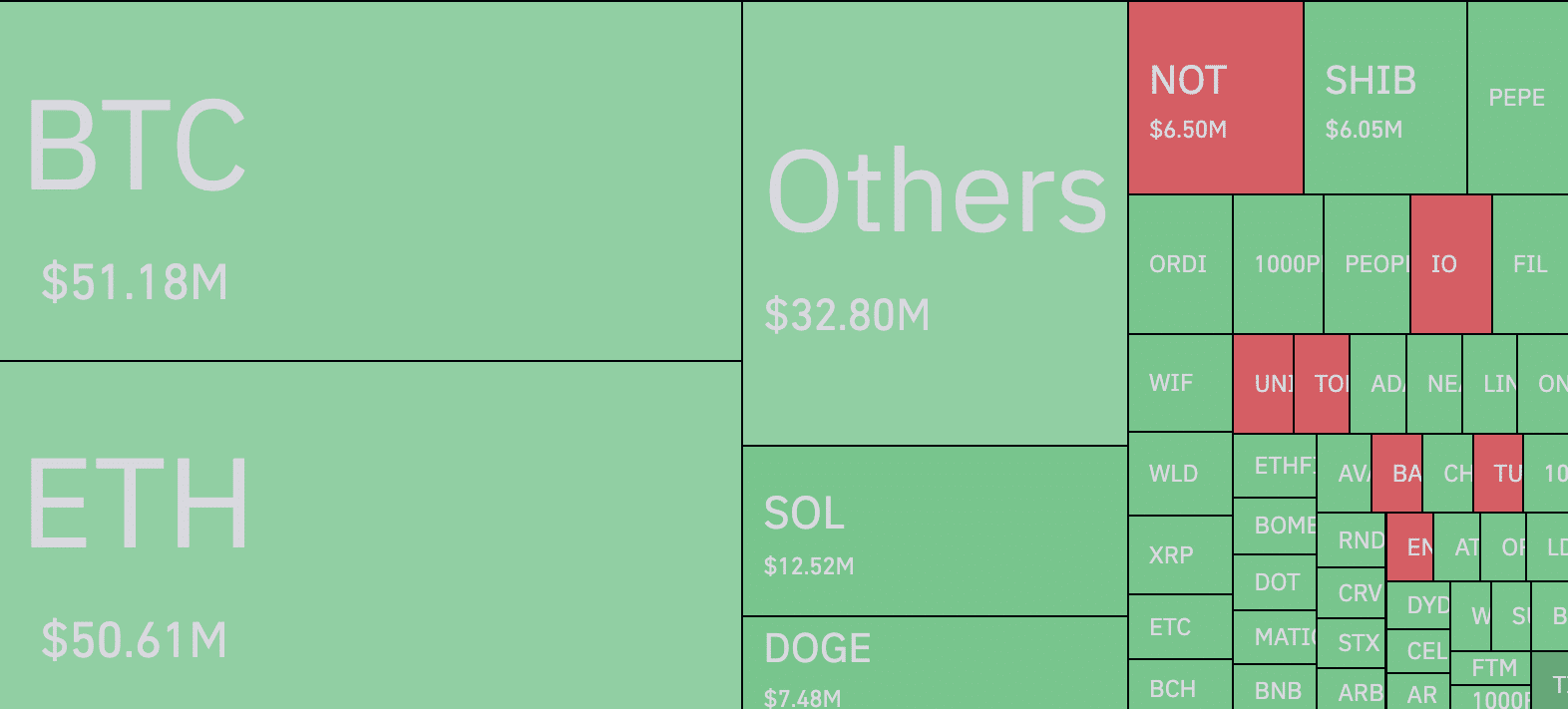

The high volatility in the market caused liquidations in the market to hit $215 million. Out of this, Ethereum [ETH] contracts accounted for $50.61 million, according to data from Coinglass.

Liquidations occur when a trader does not have a sufficient margin balance to keep a position open. The forceful closure is necessary to avoid further losses.

Stormy season for the market

For ETH, the high liquidations could be linked to the cryptocurrency’s price. A look at the price action revealed that it dropped to $3,368 at some point on 14 June. Later on, the value rose to $3,512, before settling above $3,500 at press time.

As a result of these price swings, both longs and shorts were not spared. Longs refer to traders betting on the price of an asset to hike. Shorts, on the other hand, are traders with stakes on a price decline.

However, traders seemed to expect the depreciation in price. This, because of the Put/Call ratio before Friday’s options of expiry. According to Deribit, the derivatives exchange, Ethereum’s Put/Call Ratio was 0.37.

Since the ratio was below 0.50, it meant that expectations have been bearish. However, it did not seem the participants anticipated the high level of volatility.

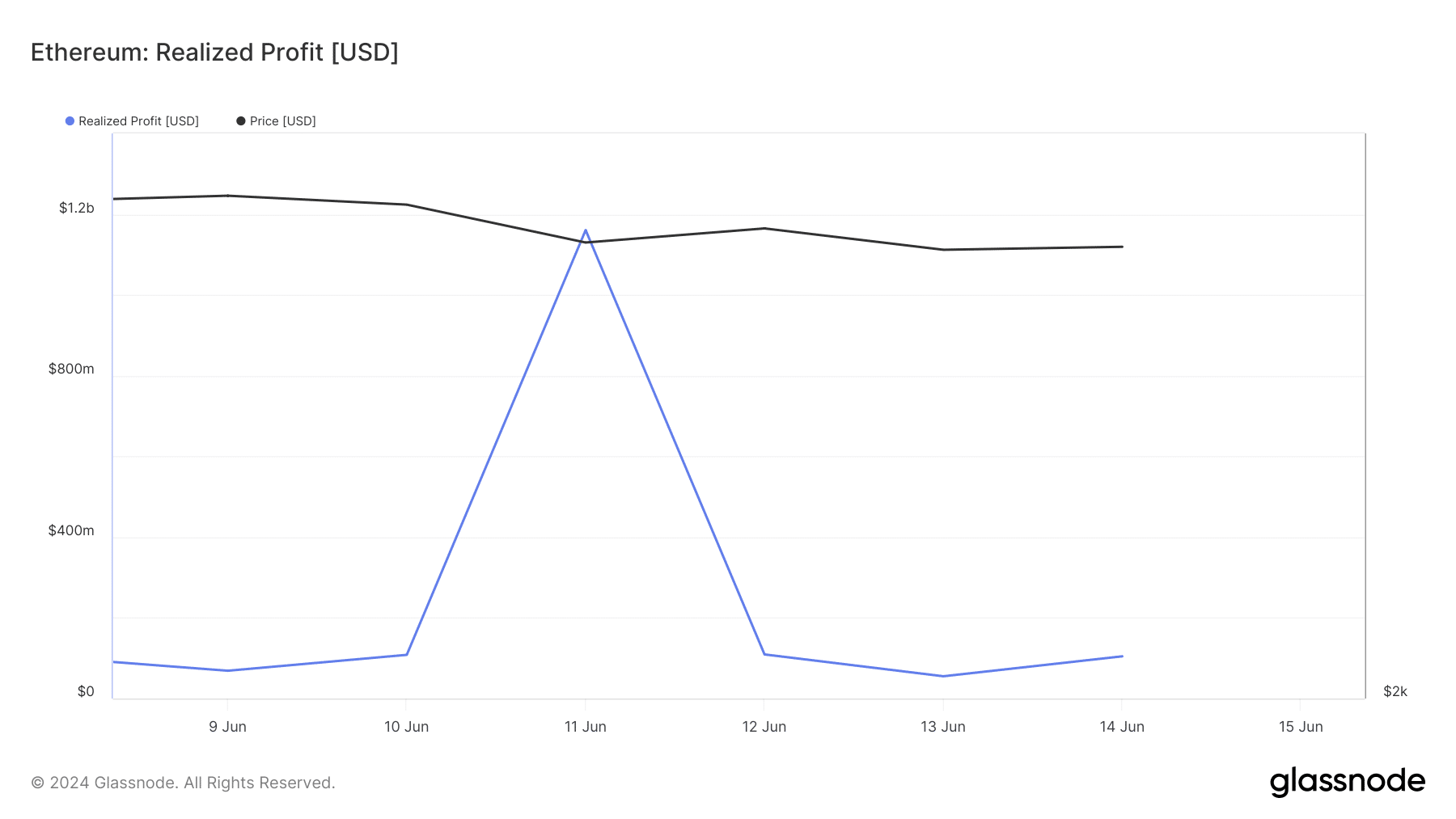

In terms of the price, AMBCrypto looked at the Realized Profit too. As the name implies, this denotes the total of all moved coins whose last price was lower than its press time value.

ETH plans to swing between $3,400 and $3,600

On 12 June, ETH’s Realized Profit was $55.18 million. By 14 June, the value had risen to $104. 58 million. An increase in this metric implies that holders are booking profits, and this could lead to a price fall on the charts.

However, if the metric stabilizes itself, selling pressure reduces across the market. For Ethereum, Realized Profit seems to have settled around the aforementioned value. Therefore, it might be likely for the altcoins to trade between $3, 400 and $3,600 over the next few days.

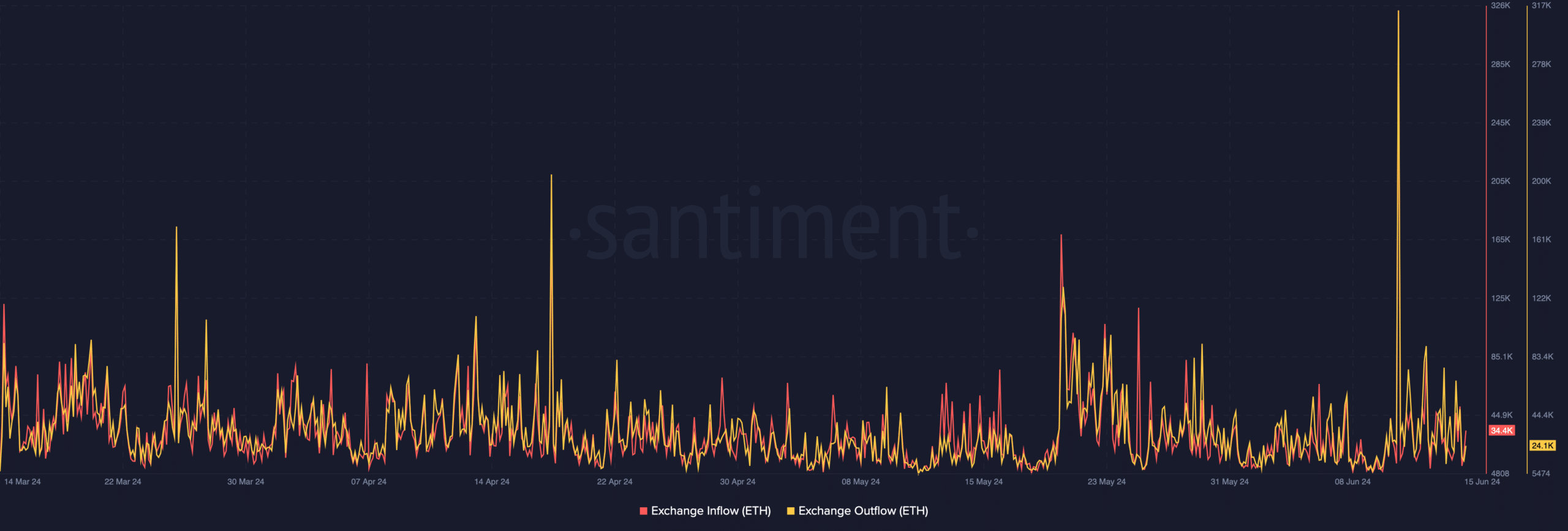

AMBCrypto also analyzed Exchange inflows and outflows to assess ETH’s next movement. Exchange inflows track the number of coins sent into exchanges.

If this increases, it means that holders are planning to sell. When this happens, the price of a cryptocurrency usually decreases. Exchange outflows, on the other hand, measures the number of coins sent out of exchanges.

At press time, ETH’s Exchange inflows were $34,400 while the altcoin’s outflows were 24,100. The difference in the flows implied that there were more ETH up for sale, than those retired to cold wallets.

If this continues, the price of the cryptocurrency might drop below $3,400 like it did on 14 June. On the other hand, a fall in selling pressure could halt this decline and ETH might keep consolidating on the charts.