Does VanEck’s Ethereum projection signal rising institutional interest?

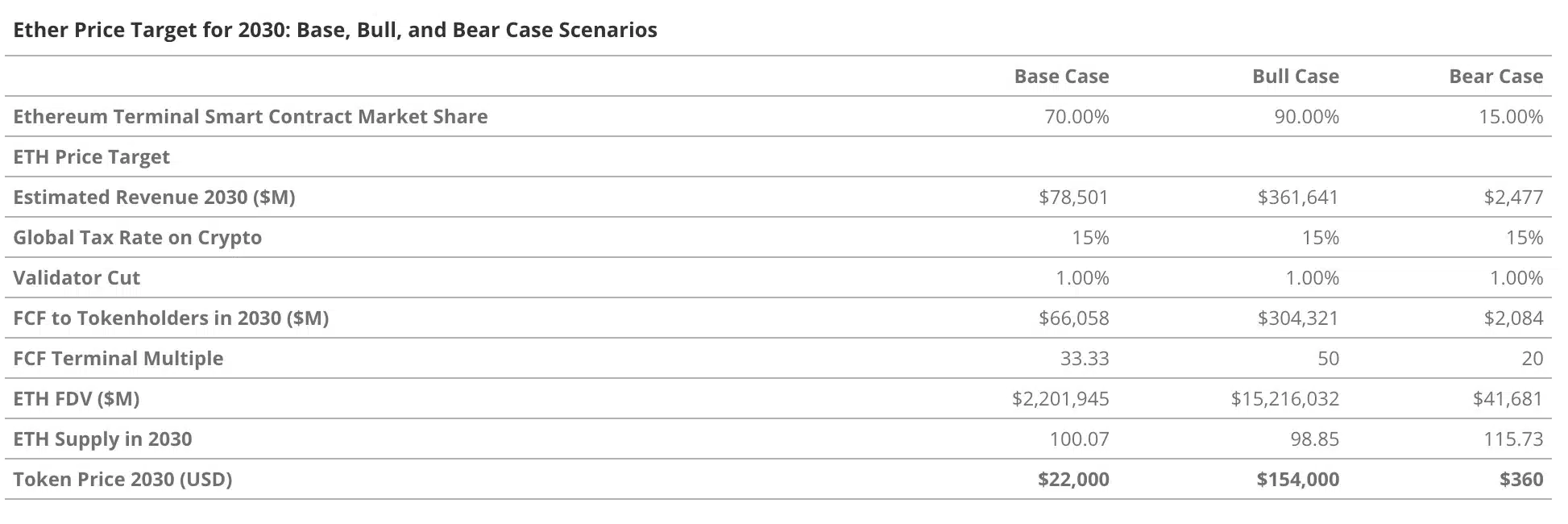

- VanEck projects Ethereum at $22,000 by 2030, fueled by ETF approval and institutional adoption.

- VanEck says ETH could hit $154,000 in a bullish market and fall to $360 in a bearish one.

After days of anticipation, Bitcoin [BTC] surpassed the $70K milestone on 5th June. Mirroring this upward trend, Ethereum [ETH] experienced a 1.34% increase at the time of writing.

Increased institutional interest

Amid the positive market momentum, VanEck, a prominent asset manager, projected that Ethereum will reach $22,000 per coin by 2030.

This bullish prediction is based on the anticipated approval of spot Ethereum exchange-traded funds (ETFs), expected to take place in July.

Elaborating further on the matter, VanEck in its recent blog post noted,

“This development would allow financial advisors and institutional investors to hold this unique asset with the security of qualified custodians, and benefit from the pricing and liquidity advantages characteristic of ETFs.”

Seeing such pros, VanEck updated its financial model to evaluate ETH’s investment case. This potential market shift highlights the increasing acceptance and integration of cryptocurrencies into mainstream financial systems.

What are the metrics saying?

This sentiment was further confirmed by AMBcrytpo’s analysis of Santimnet data that revealed a hike in total supply in profits. As of the latest update, that number has risen to over 132 million.

This explains why VanEck views Ethereum as a gateway for investors that can tap into a rapidly expanding digital economy.

The firm’s analysis of Ethereum’s performance highlights impressive metrics, such as 20 million monthly active users, $4 trillion in transactions, and $5.5 trillion in yearly stablecoin transfers. It further added,

“The centerpiece asset of this financial system is the ETH token, and in our updated base case, we believe it to be worth $22,000 by 2030, representing a total return of 487% from today’s ETH price, a compound annual growth rate (CAGR) of 37.8%.”

This highlights that according to VanEck’s analysts, the base case prediction for Ethereum is $22,000. They foresee the cryptocurrency reaching up to $154,000 in a bullish market and potentially falling to $360 in a bearish one.

How is the community reacting?

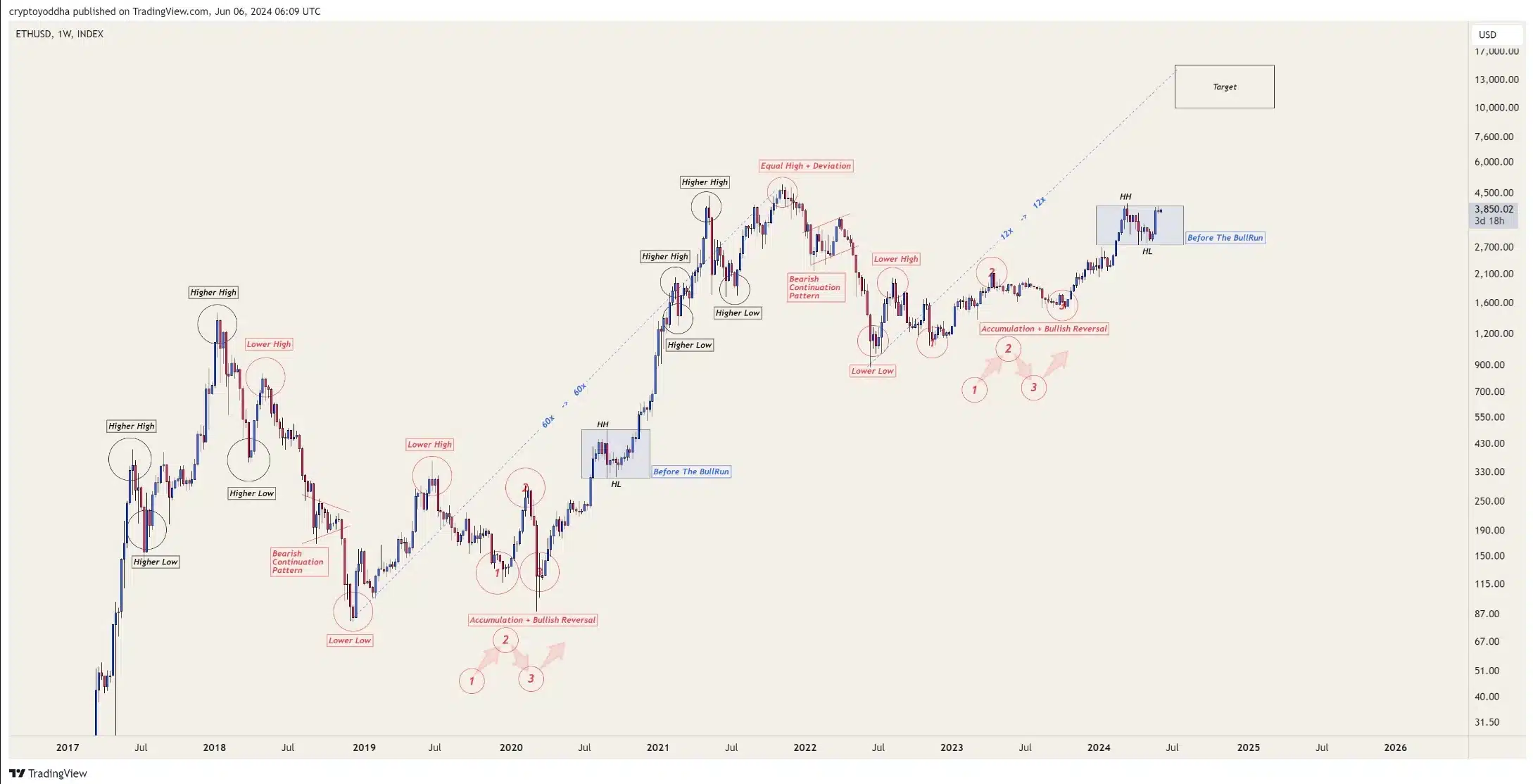

Interestingly, the community also appeared to be optimistic about ETH’s future, as noted by a well-known trader, Yoddha, who said,

“Ethereum rally is just one breakout away”