The coin faces bearish pressure but a significant rebound will depend on the upcoming FOMC meeting and one other factor.

- Long liquidations were a lot higher than shorts after BTC fell below $70,000

- Demand for the coin might decrease as sentiment remained negative

The crypto market, led by Bitcoin [BTC], witnessed a rough day at the office on 7 June as prices plunged. At press time, BTC had lost 2.83% of its value in the last 24 hours while trading at $69,262.

As a result of the decline which was reportedly triggered by a U.S jobs data , the total market capitalization dropped to $2.55 trillion. This was a 3.48% fall over a single 24-hour period. As expected, traders were not immune to the effects of this update either, according to data from Coinglass.

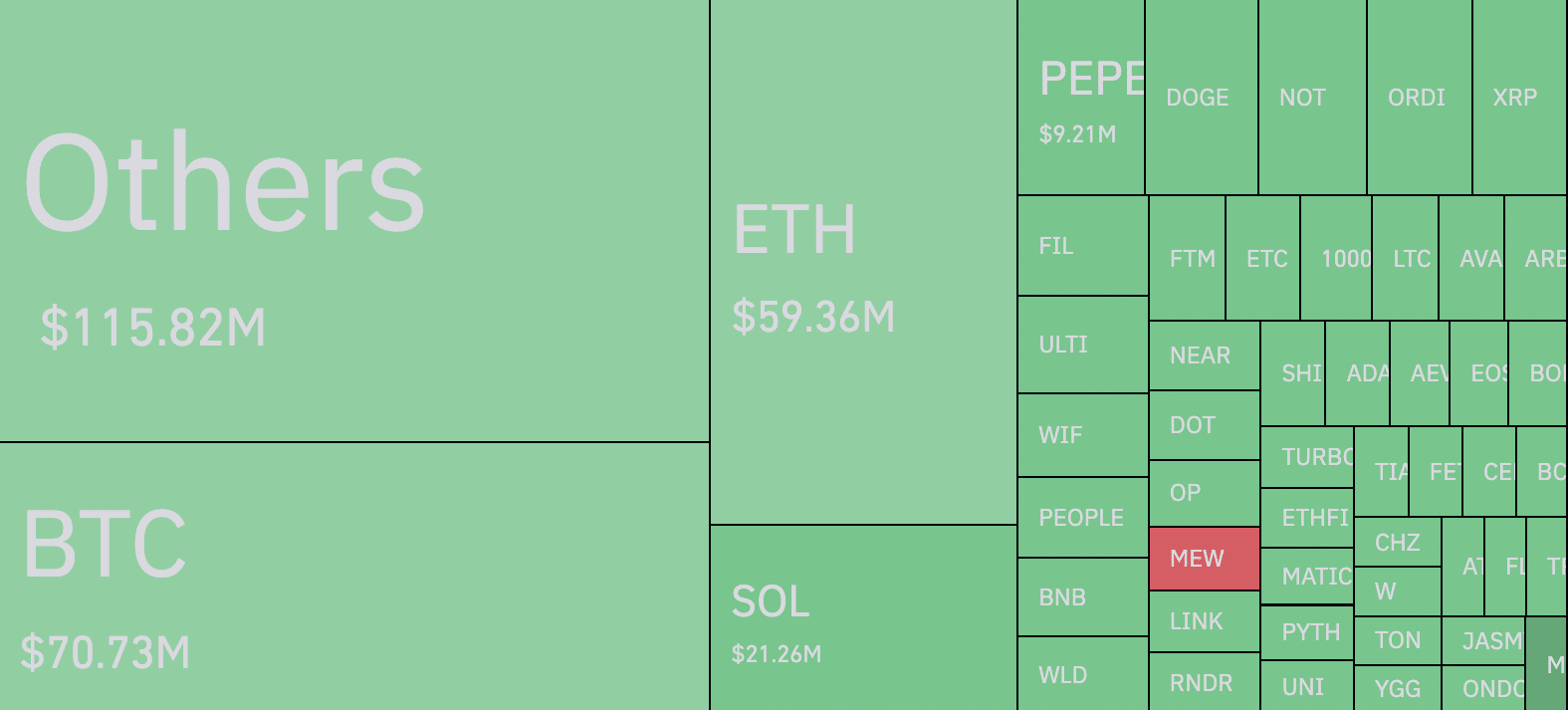

At the time of writing, the total value of liquidations was $410.42 million. Out of this, Bitcoin contracts accounted for $70.73 million.

Liquidations change the point of view

Crypto liquidations occur when market conditions are unfavorable. Because of this, exchanges forcefully close the leveraged positions of traders who can no longer satisfy the margin requirements.

Notably, a large part of the liquidations which happened within the timeframe were longs. For context, longs are traders with bets on a price hike. Therefore, it was evident that a l0t of traders were optimistic about Bitcoin’s price since it started trading above $71,000 on 7 June.

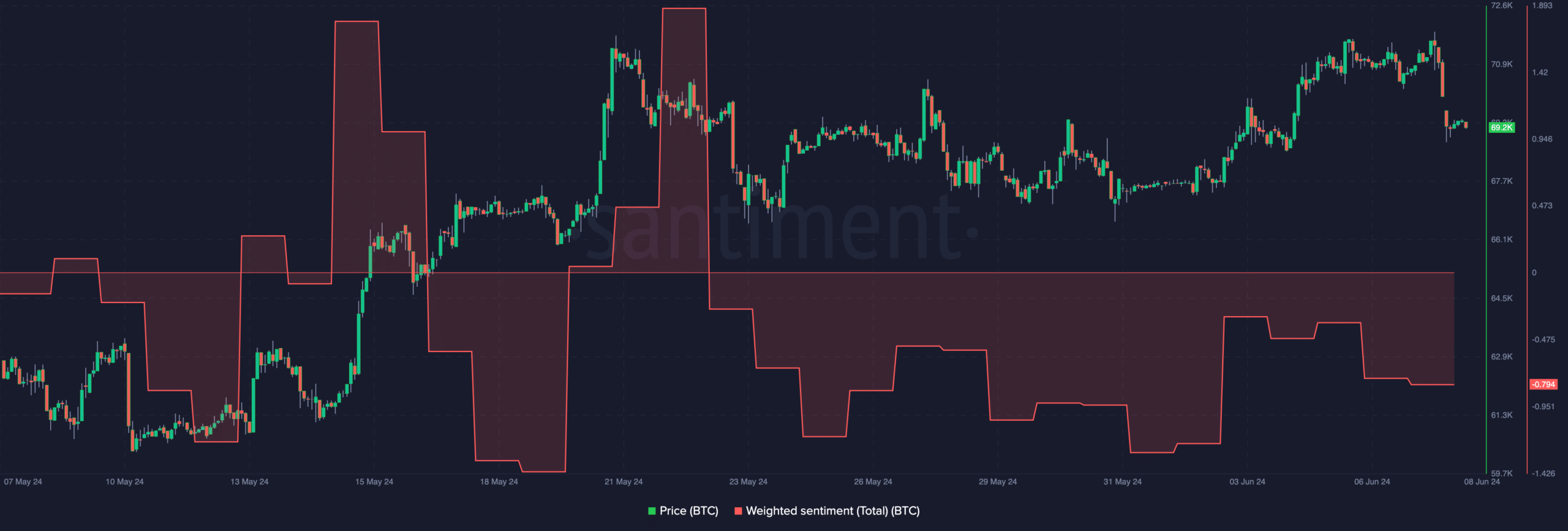

Furthermore, the fall in prices seemed to have affected the sentiment across the market. Though the Weighted Sentiment was negative before the cascade of liquidations, the reading fell further down to -0.794.

This decline implied that most of the conversations about Bitcoin online tilted towards the bearish side. As such, demand for the coin could be slow, suggesting that the price might slip on the charts again.

Should this be the case, the value of BTC could fall to as low as $67,450. However, outside of on-chain activity, a key factor supporting a rebound is Bitcoin ETF total netflows.

Next week is crucial for BTC

For those unfamiliar, a Bitcoin ETF is a product that exposes investors to the price movement of the financial instrument. However, this does not mean that investors would own BTC directly.

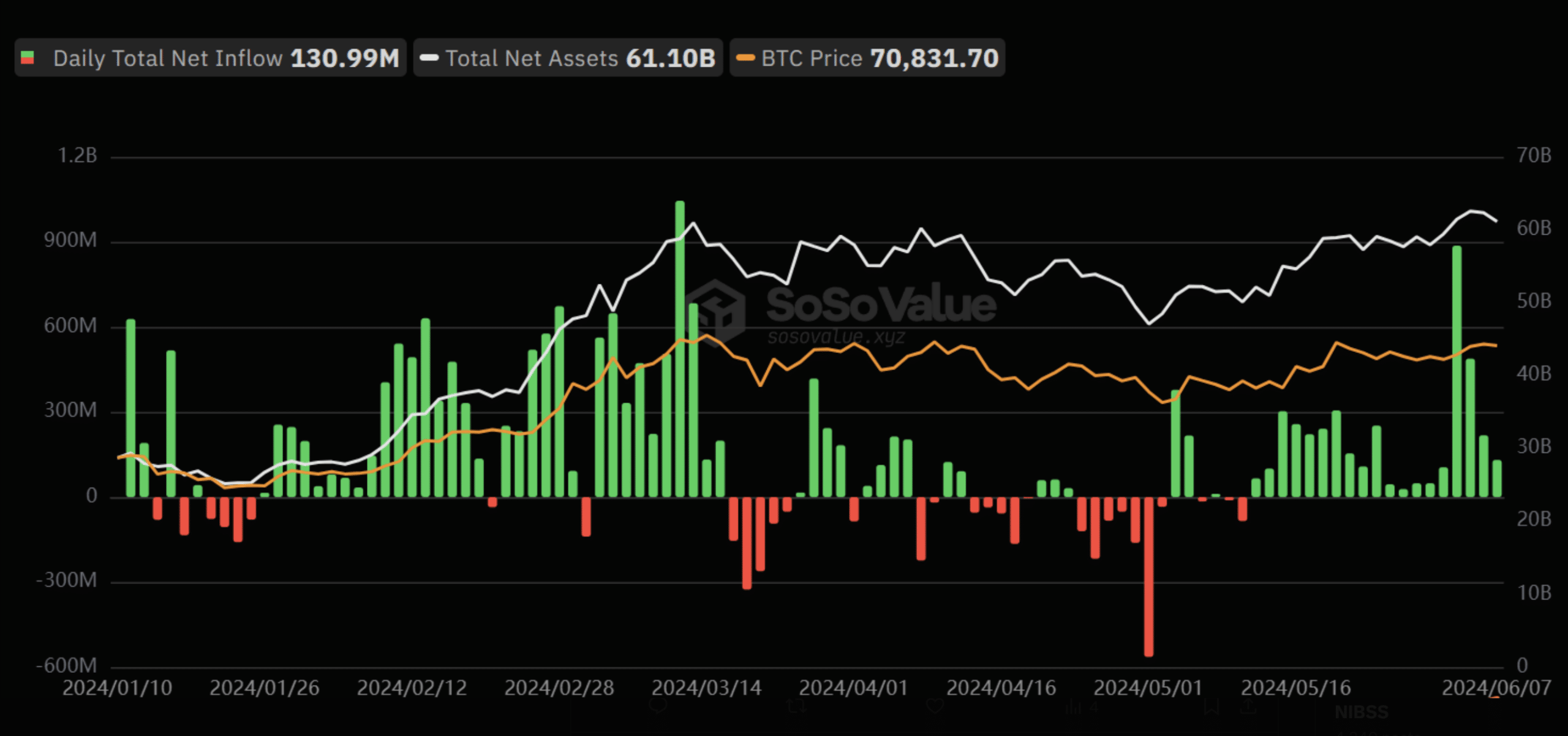

According to crypto investment tracking tools, the total net inflows on 7 June were $131 million. Giving details of the breakdown, reporter Colin Wu noted,

“On June 7, the total net inflow of Bitcoin spot ETFs was $131 million. Grayscale ETF GBTC had a single-day outflow of $36.3411 million, and BlackRock ETF IBIT had a single-day inflow of $168 million. The total net asset value of Bitcoin spot ETFs is $61.104 billion.”

While the inflows were a bit lower than previous days, the fact that it was higher than the outflows suggested that BTC could evade a significant correction. If by Monday the inflows are higher, Bitcoin’s price might revisit $71,000. If not, the price could swing sideways.

However, one other thing that can affect Bitcoin in the coming week is the FOMC meeting. FOMC stands for Federal Open Market Committee. The committee is responsible for determining the monetary policy in the United States.