Data shows the consistency of retail investors may push the price toward a new high.

- Addresses holding 10 to 100 BTC have begun accumulating more of the coin.

- With increasing volatility, Bitcoin might hit $80,000 before the end of Q3.

Since Bitcoin [BTC] failed to revisit the all-time high it reached in March, there has been speculation that the bull run is over. However, AMBCrypto found that to be untrue.

Instead, it seems Bitcoin is gearing up for the second leg. One thing common to a bull cycle is the active participation of retail investors.

If we take back to the 2017 and 2021 cycles, Bitcoin did not hit the top until there were a lot of small investors in the market.

Small investors are showing strength

But in March, the rise to $73,750 was fueled by institutional capital. However, the billions of dollar that drove BTC at that time has been dwindling for some months. Hence, the price has been correction and consolidating.

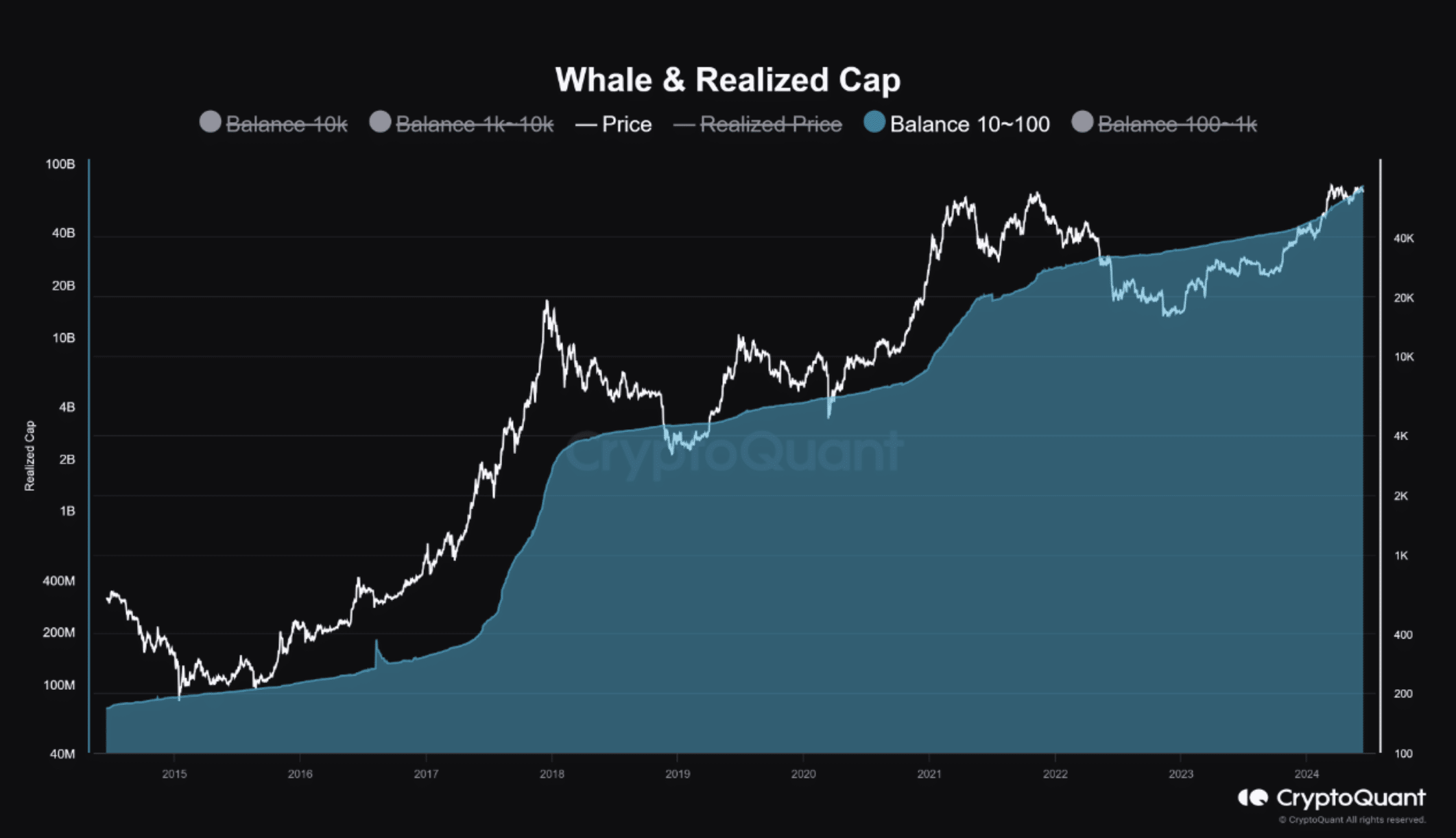

However, thing may be close to changing, according to data shown by the Whale and Realized Cap metric.

This capitalization model looks at the flow of funds from smaller whales and retail investors. Recently, AMBCrypto reported that the big fishes in the market have been capitalizing on the dip.

Now, it seemed that others have joined as seen by the rise in the balance of the 10 to 100 BTC cohort. In past cycles, a situation like this acts as the first stage of another rally after Bitcoin might have experienced a 20% to 30% correction.

Crypto Dan, an on-chain analyst and author on CryptoQuant shared a similar view. In his analysis, he explained that,

“Since 2024 is the time when the inflow of small whales and general investors began to rapidly increase, and the second half of the bull market has only begun, the possibility of additional capital inflow and a strong rise in Bitcoin can be seen as open in the near future.”

BTC may reach $80,000 soon

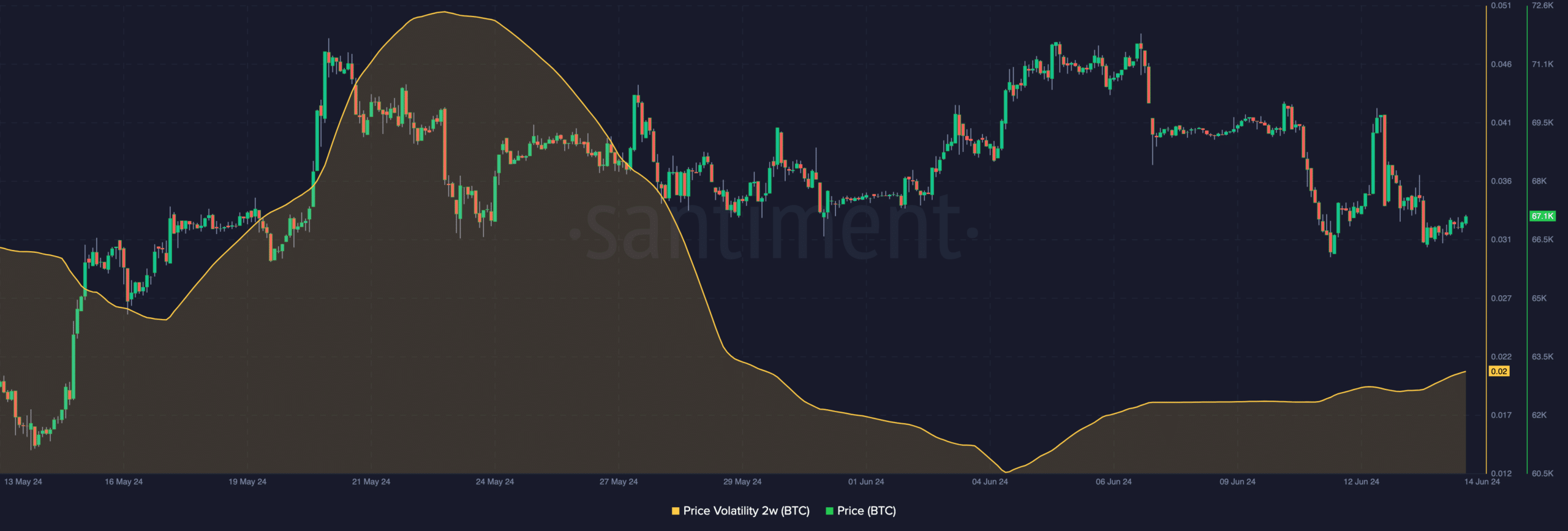

Still, this does not imply that BTC would not hit a lower value before another rally begins. To further validate this potential re-start of the rally, AMBCrypto examined the volatility around Bitcoin.

At press time, on-chain data showed that the two-week volatility had risen to 0.02. Volatility shows the potential for upward or downward movement. If the reading is low, it means that a cryptocurrency might trade within a tight range.

On the other hand, rising volatility imply that prices may experience notable swings. However, this depends on the buying or selling pressure in the market.

For Bitcoin, its price might see a significant upswing soon. But that would depend on the consistency retail investors have in accumulating the coin.

Should buying pressure increase, Bitcoin’s price might jump toward $80,000 around the beginning of the third quarter (Q3).

However, this prediction may not see the light of day if selling pressure continues till that moment.