Bitcoin (BTC/USD) is currently hovering around $71,000, marking a slight decrease of 1%. Despite this, the key pivot point at $70,600, indicated by the green line on the chart, is a crucial marker for traders eyeing a positive shift in crypto price predictions.

With recent dynamics in U.S. economic data and record inflows into spot Bitcoin ETFs, the digital currency remains a focal point of interest.

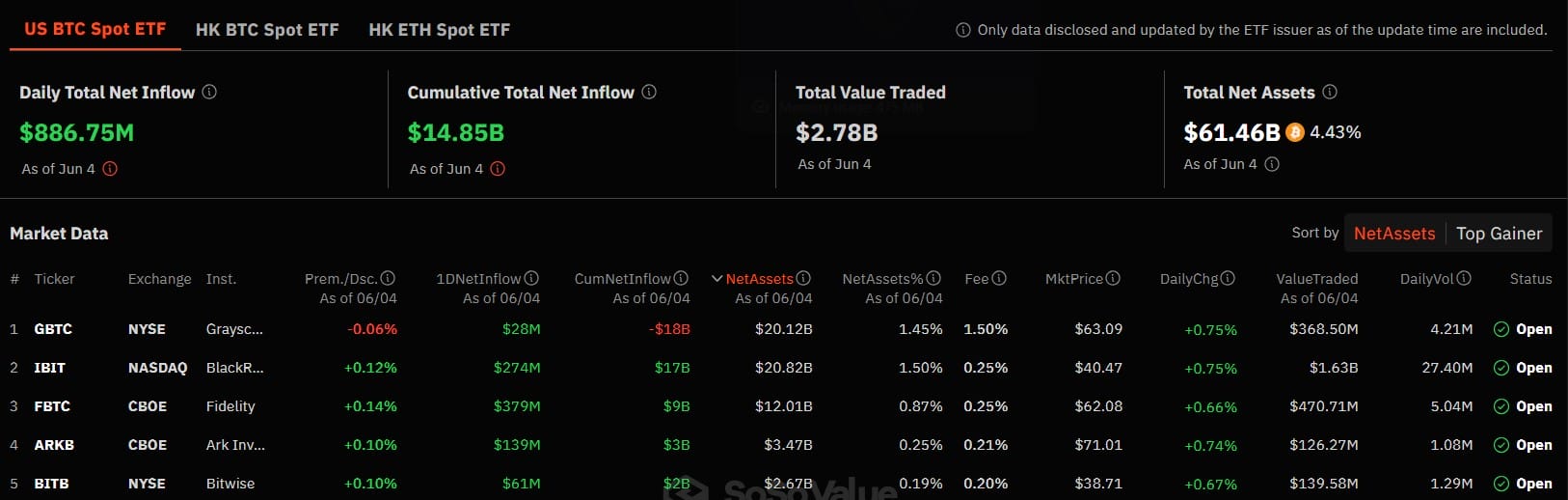

Spot Bitcoin ETFs Surge with $61 Billion in Holdings Amid Record Inflows

U.S. Spot Bitcoin ETFs have shown impressive performance, continuously attracting investments over the past 16 days.

On a notable trading day, these ETFs collected $886.6 million, marking it as the second-largest daily inflow since a record $1.04 billion on March 12, 2024.

This day’s inflow amounted to 85.25% of the March peak.

Leading the inflows, Fidelity’s FBTC garnered $379 million, followed by BlackRock’s IBIT with $274 million, and Grayscale’s GBTC added $28 million. Collectively, on that day, the trade volume reached $2.49 billion.

June 4th U.S. spot #Bitcoin #ETFs recorded their second-highest joint net inflow day, with $886.6 million in inflows, led by Fidelity’s Bitcoin fund. pic.twitter.com/EQxxJJDaEe

— Dr Martin Hiesboeck (@MHiesboeck) June 5, 2024

- Current Holdings: BlackRock’s IBIT is now the largest holder with 295,457.46 BTC valued at approximately $20.96 billion.

- Other Major Holders: Grayscale’s GBTC and Fidelity’s FBTC hold 285,069.81 and 165,232.89 BTC respectively.

- Total Assets: Altogether, 11 U.S. spot bitcoin ETFs manage 866,435.19 BTC, worth over $61 billion.

The sustained inflows into U.S. spot Bitcoin ETFs indicate growing investor confidence, potentially driving up Bitcoin’s price due to increased demand.

U.S. Economic Data Signals Mixed Impact on Bitcoin Price Predictions

On June 5th, the ADP Non-Farm Employment Change reported 152,000 new jobs, falling short of both the expected 173,000 and the previous 188,000.

This could suggest a slowing labor market, traditionally a bearish signal for market sentiment but potentially bullish for Bitcoin as investors might seek alternative investments.

⚠️Breaking! 🇺🇸ADP Non-Farm Employment Change lower than expected!📉

May ADP Non-Farm Employment Change:

152K (est. 175K, prev. 188K)#MM pic.twitter.com/9Hh1lQo7Mk— MacroMicro (@MacroMicroMe) June 5, 2024

Conversely, the U.S. Services sector showed resilience, with the Final Services PMI maintaining a steady reading of 54.8, indicating robust service industry activity.

More notably, the ISM Services PMI exceeded expectations at 53.8, compared to the forecasted 51.0 and previous 49.4, reflecting stronger-than-anticipated economic health.

How These Indicators Impact Bitcoin Price Predictions:

- Labor Market Cooling: The weaker-than-expected job growth might encourage a shift towards non-traditional assets like Bitcoin, especially if concerns about economic slowdown prompt investors to diversify.

- Strong Services Sector: A robust service sector could temper this effect, however, suggesting resilience in the broader economy that might support a stronger dollar and potentially limit Bitcoin’s appeal as a safe haven.