As investors diversify their portfolios and look for opportunities elsewhere, Bitcoin’s ability to maintain its position could be tested.

- Bitcoin’s open interest has reached an all-time high, with a notable increase in shorting activity.

- While “cautious optimism” has kept BTC near $100K, the rally to $130K remains elusive.

Two weeks ago, market speculators set their sights on Bitcoin [BTC] hitting $100K by the end of Q4. In just 14 days, BTC has nearly reached that target, closing near $99K and setting a new ATH.

Since the election, over $4 billion has flowed into US-listed Bitcoin exchange-traded funds. This week, BlackRock’s ETF options saw a strong debut, with call options—bets on price increases—outpacing puts.

Despite these massive inflows, BTC has yet to fully lock in its target. Each new ATH since the election has faced resistance, signaling potential overextension.

With current momentum, $100K appears within reach. However, with Bitcoin open interest at a new ATH, RSI in overbought territory, and weak hands shaking out, there are still crucial factors to watch before BTC can make its way to $130K.

High Bitcoin open interest underscores strong demand

In the last 10 trading days, Bitcoin’s daily appreciation has slowed to around 3%, a noticeable decline from the first week post-election when daily highs surpassed 10%. This reduction in momentum may indicate a cooling-off period.

However, there’s a silver lining. Unlike previous cycles, where investors typically exited as BTC entered a ‘high-risk’ zone, fearing an imminent correction, the current sentiment suggests a more cautious optimism.

This optimism is driven by bulls targeting $100K as the next key milestone for Bitcoin, motivating investors to jump in and capitalize on the rally. As a result, the number of new addresses holding BTC has doubled in the last 30 days.

The derivative market has followed suit. Data from Coinglass reveals that Bitcoin’s open interest has surged to a new all-time high of $57 billion, with more traders betting on the future direction of BTC’s value.

In short, these factors underline strong demand at current price levels. FOMO is fueling continuous interest, keeping BTC resilient despite signs of overextension.

However, while this momentum may be sufficient to keep BTC near $100K, its next upward target hinges on the sustained strength of this trend, supported by a favorable macroeconomic backdrop.

Conversely, if short-sellers in the derivative space regain traction, and FOMO fades, a long-squeeze could push BTC down to $89K before a move to $130K is viable – unless the current range flips into solid support.

Odds of $100K converting into firm support

Looking at this chart, many altcoins are approaching key areas of interest, while BTC appears to be on the verge of another potential fakeout above the local range highs.

This signals caution, as Bitcoin’s upward move could be short-lived or deceptive. Meanwhile, altcoins are nearing crucial price levels where significant price action is likely.

Typically, when BTC hits a target price, capital shifts toward altcoins, with investors aiming to reduce risk and redistribute profits across the broader market. This often acts as a major resistance to BTC’s rally.

Therefore, converting this resistance into support – by seeing substantial capital flow ‘into’ rather than ‘out’ of Bitcoin – will be crucial in determining whether the $100K range can hold in the long term.

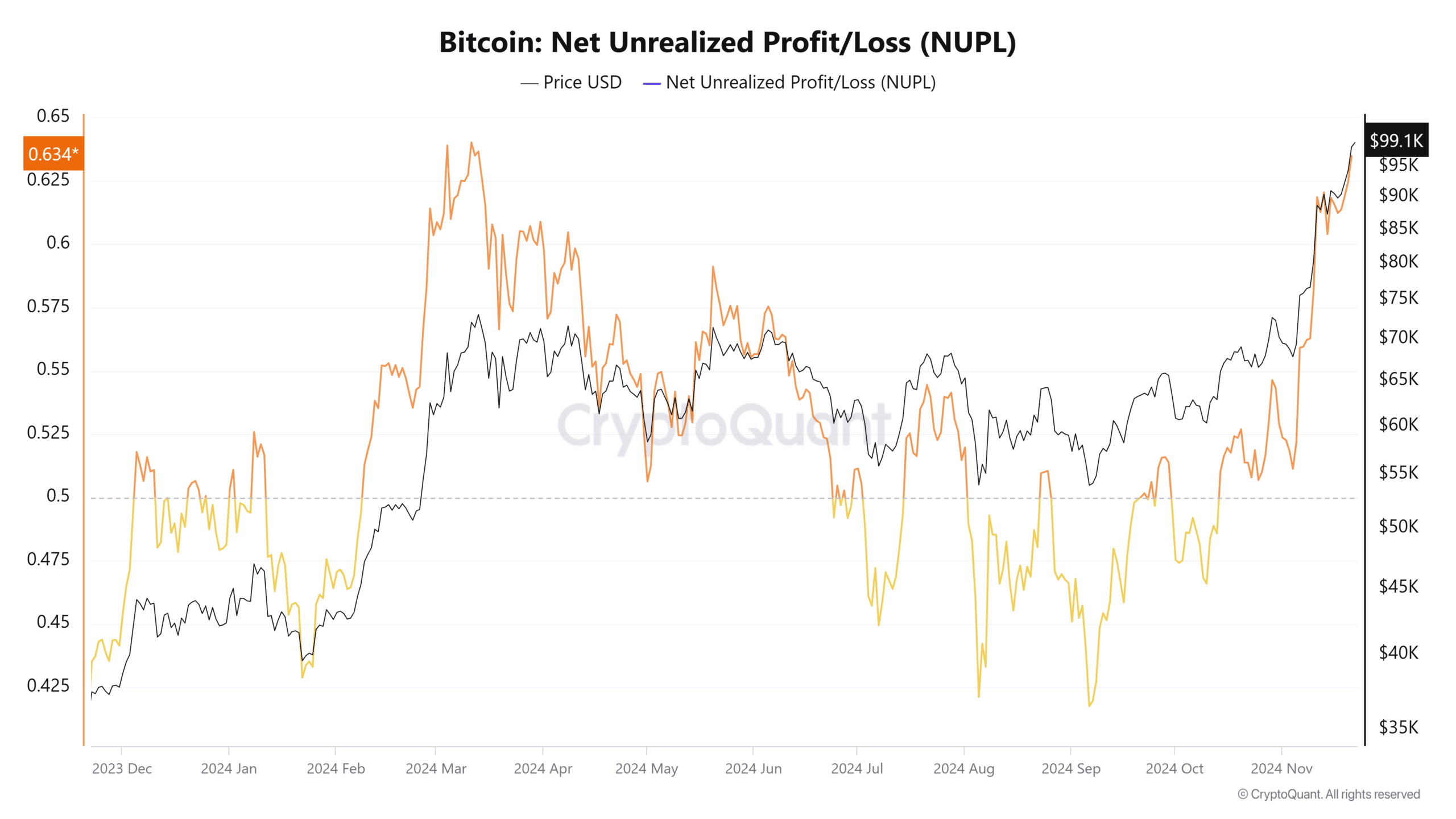

Interestingly, the NUPL indicator is reflecting a pattern similar to the March trend, where many “weak hands” started cashing out on profits, fearing the rally was nearing its peak.

As mentioned earlier, demand has remained strong, absorbing selling pressure despite the market overheating. However, a potential top could still be near, especially if major altcoins continue to outperform Bitcoin.

Solana, in particular, is positioning itself for significant moves ahead of its highly anticipated ETF listing, which could shift market dynamics in the coming days.

In summary, while BTC is on track to hit $100K, with Bitcoin open interest reaching new ATHs, high FOMO sustaining new interest, and strong demand counteracting signs of overextension, other factors could still influence its trajectory.

The performance of altcoins, market sentiment, and external events may be crucial in determining whether Bitcoin can sustain its momentum or face a correction before advancing toward $130K.

This scenario seems probable, especially considering the notable shorting activity within Bitcoin’s open interest and the increasing interest from investors seeking more affordable assets, which is understandable considering the high stakes surrounding Bitcoin at these elevated price levels.