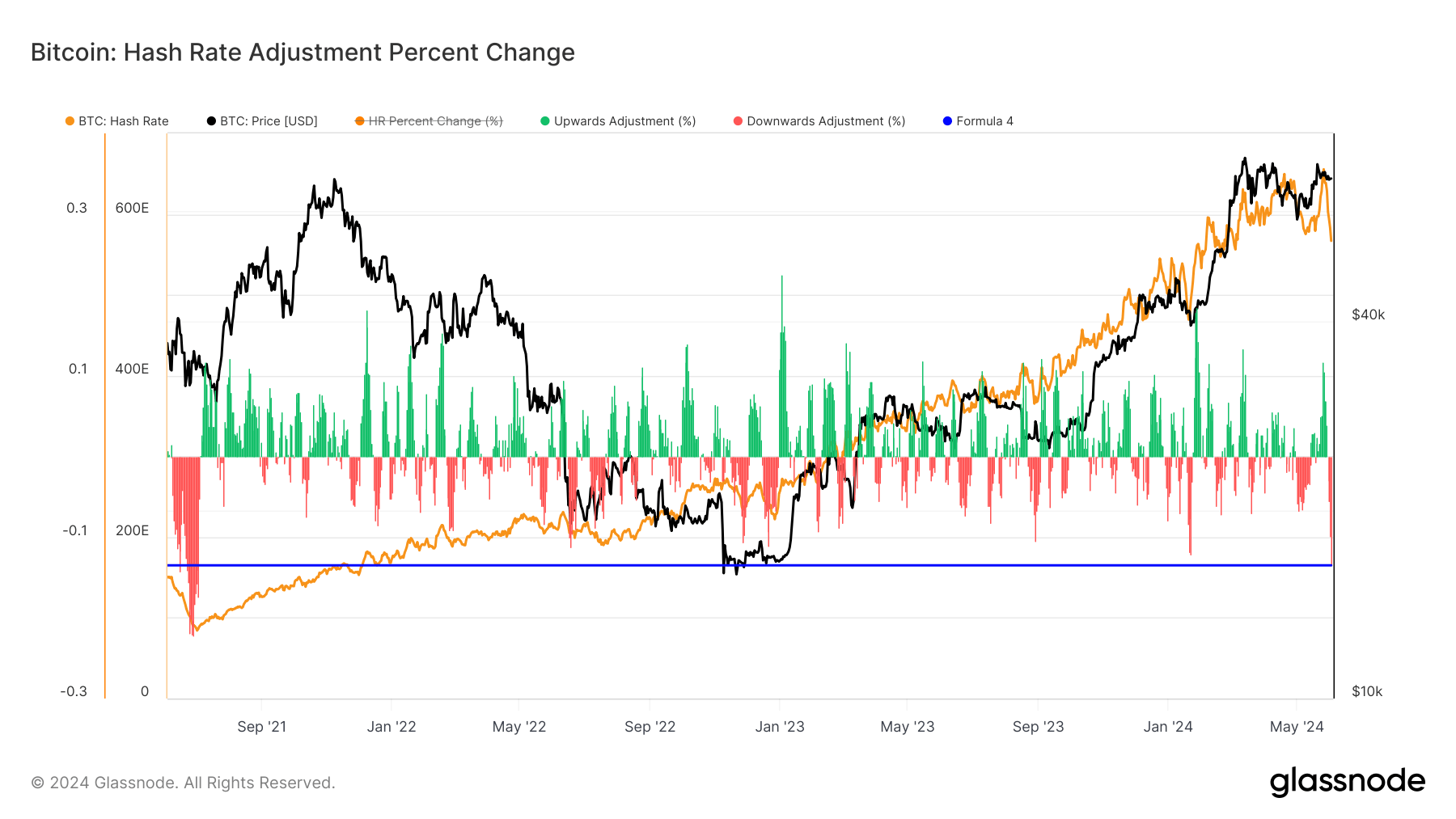

Hash ribbon metric reveals ongoing miner capitulation as hash rate drops 14%.

A recent analysis by CryptoSlate indicates that Bitcoin miners continue to capitulate, as evidenced by the hash ribbon metric.

Glassnode data shows that the current hash rate, observed on a seven-day moving average, has dropped to 567 exahashes per second (EH/s), marking its lowest point since the post-halving period. This is a significant drop from the peak hash rate of 655 EH/s.

Over the past week, the hash rate has declined by 14%, representing the steepest 7-day moving average decrease in Bitcoin’s hash rate since July 2021, during the China mining ban — which experienced an over 22% drop.

Despite the declining hash rate, the upcoming difficulty adjustment, set for May 6, is expected to increase by over 1%, according to Newhedge.

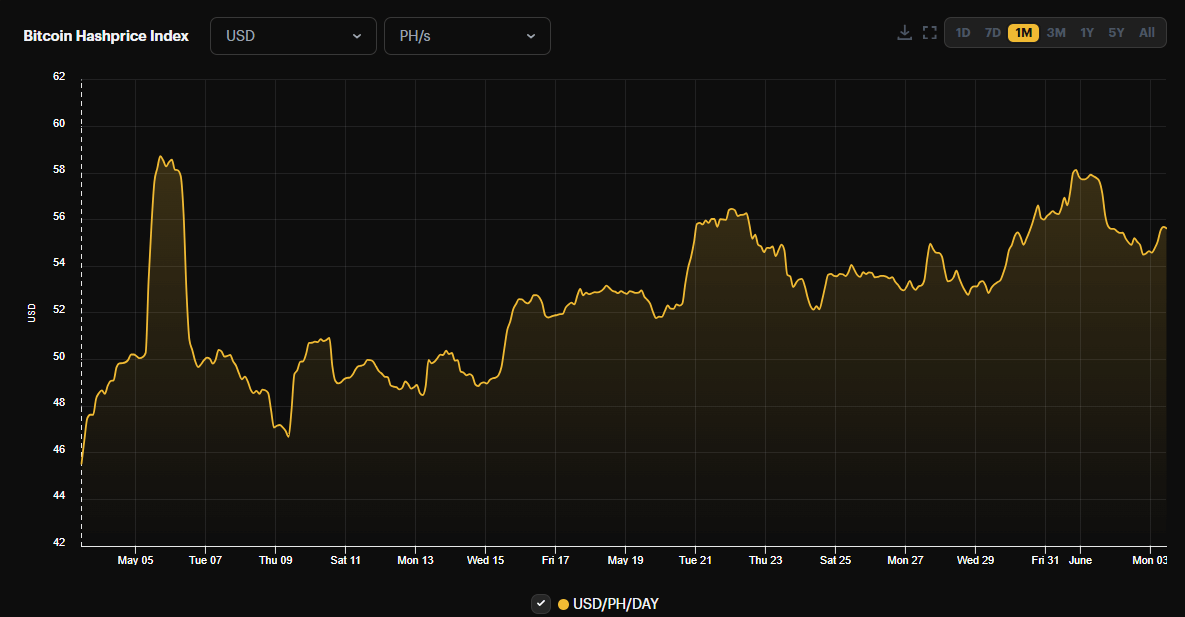

Interestingly, hash price data from Luxor shows a slight upward trend. It is currently valued at $56 per petahash per second (PH/s), up from a low of approximately $45 PH/s on May 1.

The rise in hash price suggests that despite the potential rise in mining difficulty, miners’ potential profitability is also improving, offering some respite amid the current challenges.