Transaction fees on Bitcoin decreased significantly after an initial spike. But that’s not all.

- Bitcoin fees dropped after the halving, reducing miner revenue in the process.

- Runes might cause a surge in activity on Bitcoin’s block space, and fees might spike again.

Bitcoin [BTC] fees have been a major subject in the crypto market since the halving on the 20th of April. The day before the halving, the average fee on the Bitcoin network surged to $128.

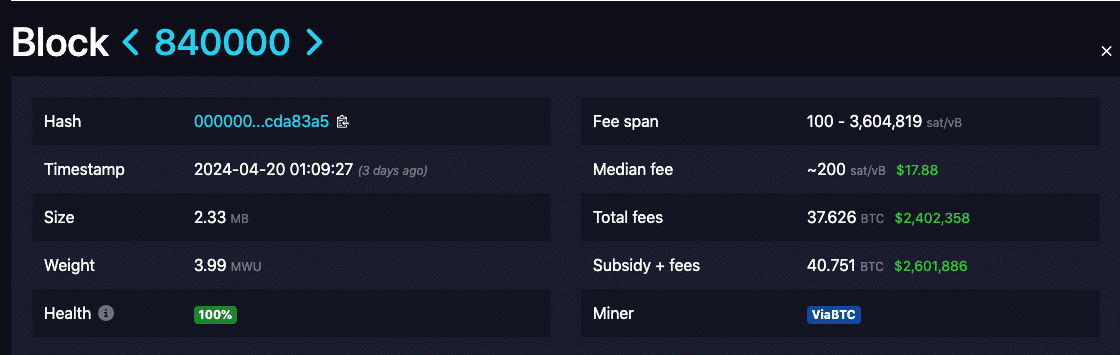

On halving day itself, the total fees paid to have a transaction processed on the 840000th block was a mind-blowing $2.40 million. This value was equivalent to 37.62 BTC, according to mempool.space.

But as of the writing, the fees have crashed and were an average of $8 to $10. But why did the fees spike in the first place?

In this piece, AMBCrypto explains Bitcoin fees, why they suddenly increase, and what else to expect. Read on.

Bitcoin fees: A way to reward miners

Bitcoin fees are also known as transaction fees on the network. They are paid to miners as an incentive for keeping the network up and running.

Most times, the average fee needed to process a transaction is small. However, the unexpected increase that happens sometimes, could be due to the size of the transaction or congestion on the network.

Here is a simple explanation. On the Bitcoin network, data space for each block is not boundless but limited.

Therefore, if miners have to process a high number of transactions within one block, the fee becomes higher for the participant.

When does this happen? Bitcoin fees become extremely high when a lot of participants want their transactions processed fast. However, this last weekend was not the only time fees on the network spiked.

In January 2023, the launch of Ordinals created congestion on the network. At that time, besides high fees, miners found it hard to process every transaction on each block, causing the network to stall for some time.

Thus, if you want faster transactions when the network is congested, you would need to pay a higher fee. Alternatively, you can wait for the fees to be lower before trying to have your transactions confirmed.

However, this could take hours, and one time in the past, it took days.

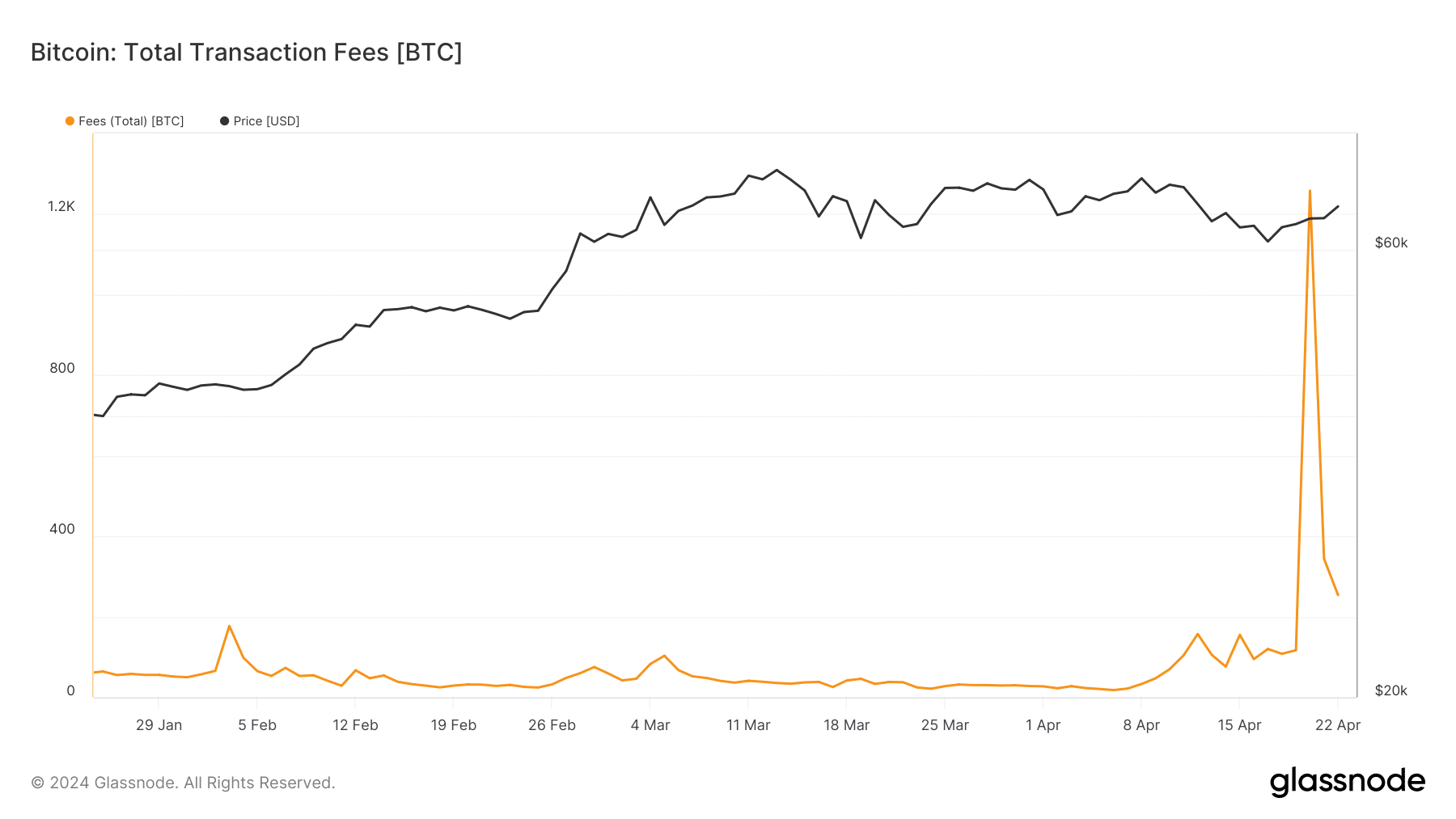

According to AMBCrypto’s on-chain analysis using Glassnode, fees on the network rose to 1,257.71 BTC on 20 April.

Recall, that it was also on the same day that miners’ rewards were cut in half— from 6.25 to 3.125 BTC.

But at the time of writing, the metric was down to $253.93 BTC, indicating that congestion on the network had decreased.

Runes and Ordinals to affect Bitcoin fees and miners-How?

In the future, there is a chance that congestion might return because of the development of Runes. The Runes protocol is a standard for minting tokens on the Bitcoin network.

For Bitcoin developer Casey Rodarmor, Runes offers a more efficient way to create fungible tokens in a way that Ordinals cannot.

Interestingly, Rodarmor was also the creator of Ordinals, which led to the development of BRC-20 tokens.

While tokens have not officially launched on Runes, Rodarmor explained why Runes was better than BRC-20 on his X (formerly Twitter) page. According to him,

“One advantage of runes vs BRC-20 is that if you have a UTXO which has some quantity of runes, you can create multiple PSBTs offering to sell different quantities of those runes from the UTXO, with runestones that transfer different amounts to the buyer and return the remainder the seller.”

For context, UTXO stands for Unspent Transaction Output. On the protocol, the UTXO represents the balance of coins that a user can spend in the future via a specific address.

For miners, Runes can have a lot of benefits. Theoretically, the development could increase transaction volume on the network.

This, could, in turn, improve Bitcoin fees and miners’ revenue which is expected to shrink might have gotten a saving grace.

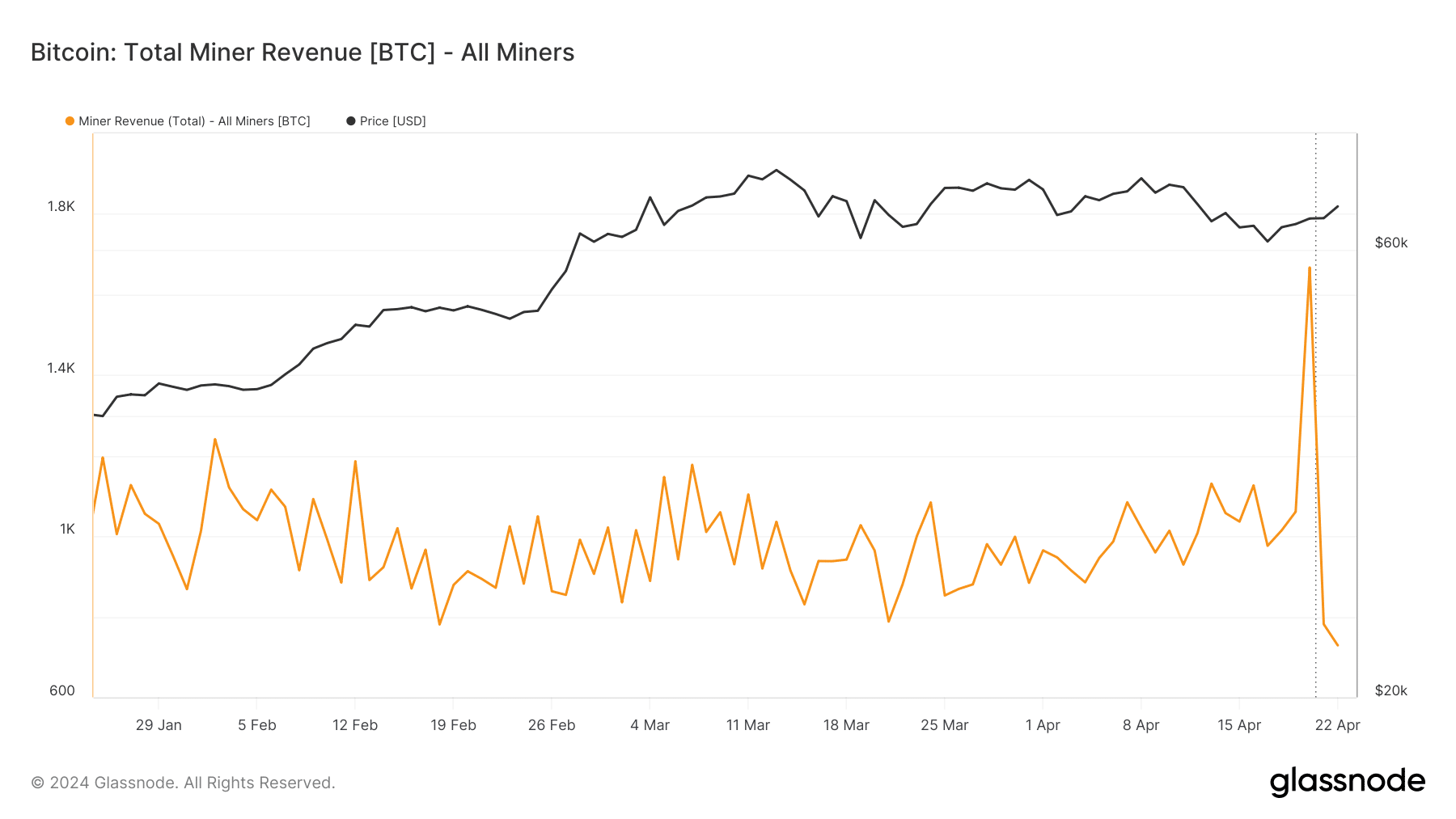

In the meantime, AMBCrypto looked at miners’ revenue. This metric is the total of fees and block rewards miners get.

At press time, the total revenue was 728.93 BTC, which was a 38.83% decrease from what it was on the day of the halving.

In the short term, Bitcoin fees might remain low and affordable. However, users should not rule out another spike in fees, especially as tokens on the Runes protocol might soon be deployed.

If the tokens come to life, participants might engage the OP_RETURN. For context, the OP_RETURN allows people to add arbitrary to transactions.

Should this become rampant, the standard locking scripts could trigger high demand for BTC, cause congestion on the network again, and fees could return to the anomaly.