- The increase in realized losses on-chain indicates that another BTC rally was close.

- Historical data presented by the cycle detector shows the coin is not in a bear phase.

If the current cycle is still in a bull phase, then Bitcoin [BTC] is close to its bottom. This was the indication AMBCrypto got after looking at the Short Term Holder (STH) SOPR.

SOPR stands for Spent Output Profit Ratio. This indicator gives insights into the realized profits of all coins traded on-chain. But this time, the focus is on the short term.

Are losses great for Bitcoin’s price?

If the STH-SOPR is greater than 1, it means that the price at while BTC was sold is greater than the purchase value. This indicates a lot of realized profits on-chain.

However, when, the metric is below 1, it means prices sold are higher than weighted buying value. This indicates realized losses on-chain. According to CryptoQuant, Bitcoin’s STH-SOPR was down to 0.98.

Historically, when this happens, it implies that Bitcoin has hit the bottom or it is close to it. As seen in the image above, it was a similar occurrence in September 2023.

Around that time, Bitcoin’s price was $26, 253. The SOPR had also dropped to a similar region. By November of the same year, the coin had reached $35,441.

Other bull cycles like 2021 and 2018 also show similar trend, indicating that the pattern often rhymes. Should this be the same case, the price of Bitcoin could jump by 34.99% in less than two month.

At press time, BTC’s price was $57,154. Going by this calculation, the price of the coin could trade around $77,100 in September.

Should this become reality, it means that BTC could reach a new all-time high this quarter.

However, irrespective of the positive outlook, it is important to check if the cycle is still in a bull phase.

Bears, it’s not yet your time yet!

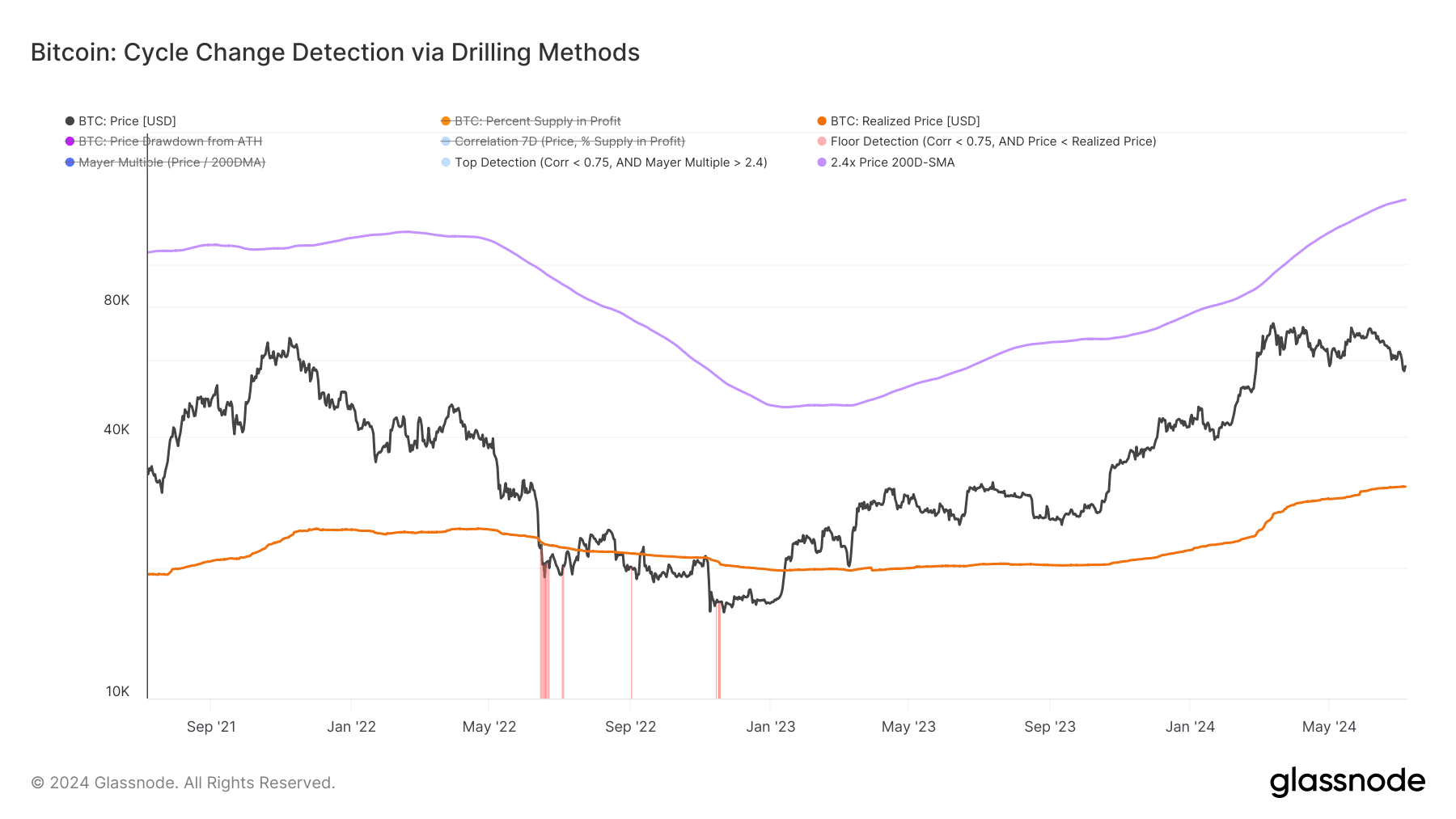

Previously, when Bitcoin dropped to $54, 274, there were calls of a return to the bear market. But opinions do not validate things like this. That was why AMBCrypto looked to Glassnode to have first-hand information of the situation.

To do this, we examined the Bitcoin Cycle Change Detector. This detector spots transitions from a bull market to a bear market. It also tells if a bear market has changed into a bull one.

If the market changes to a bear one, the shade on the chart turns red. This was evident from the market condition of November 2022. But as of this writing, that was not the case.

Except the total Bitcoin in circulation hits nearly 100% in profits, the transition to a bear cycle would not happen. As this was the case, it is possible that BTC might have hit the bottom.

Therefore, the coin might reach a much-higher value before the quarter ends — possibly between $76,000 and a highly bullish price above $80,000.

However, this prediction would be invalidated if selling pressure hits the market like it did in recent weeks.