Historical trends suggeste

- BTC’s price was on the verge of dropping below its realized price-to-liveliness ratio.

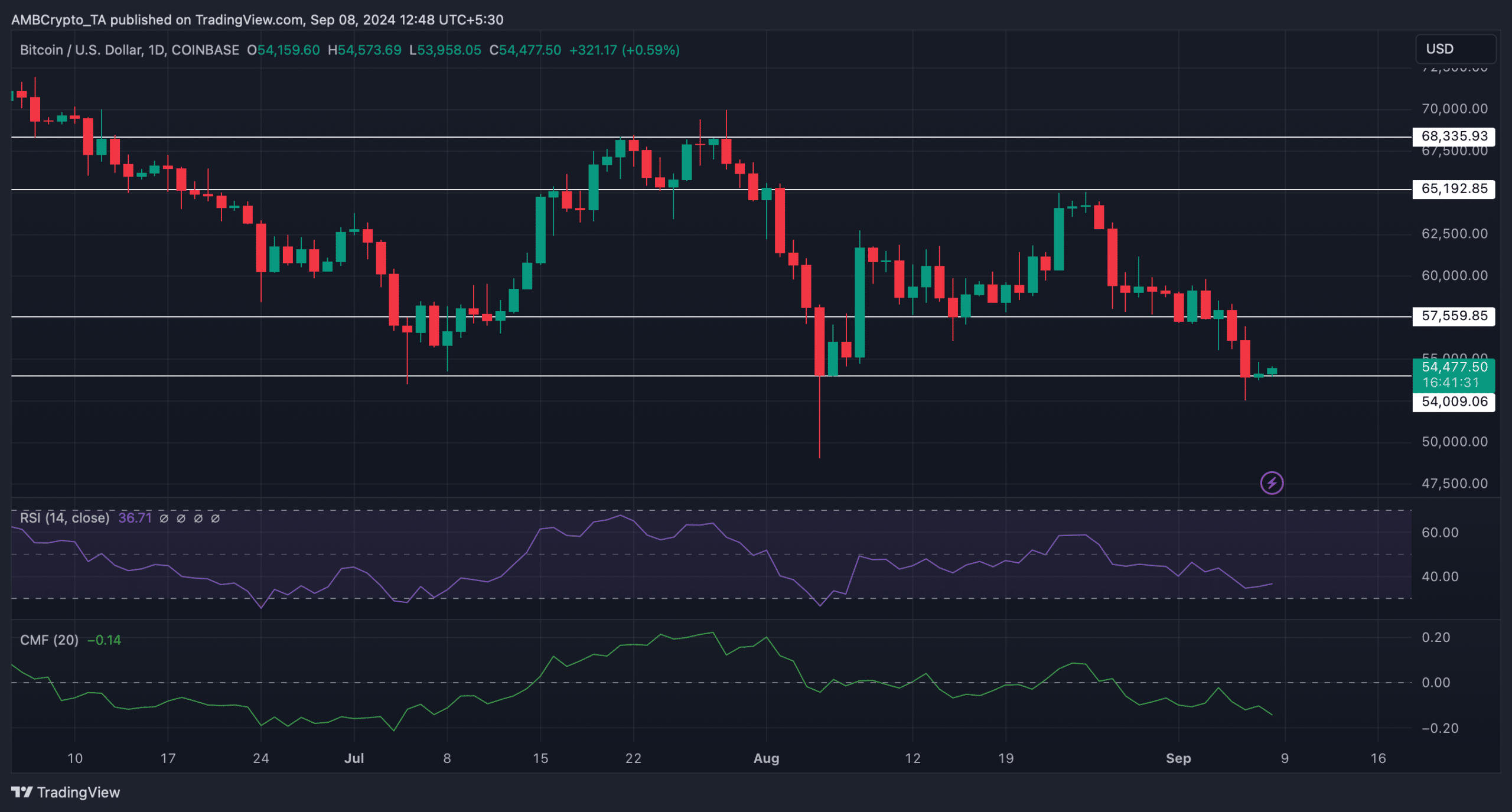

- The coin was testing a key support level at press time.

Bitcoin [BTC] investors have been struggling for quite some time now as the king coin continued to lose value. In fact, a recent analysis points out a development that indicated a bigger price drop in the coming weeks.

Let’s have a closer look at what is going on with Bitcoin.

Why Bitcoin might drop to $31k

As per CoinMarketCap’s data, the king coin witnessed a nearly 7% price drop last week. The past 24 hours were also bearish as BTC’s price declined marginally.

At the time of writing, BTC was trading at $54,306.75 with a market capitalization of over $1 trillion.

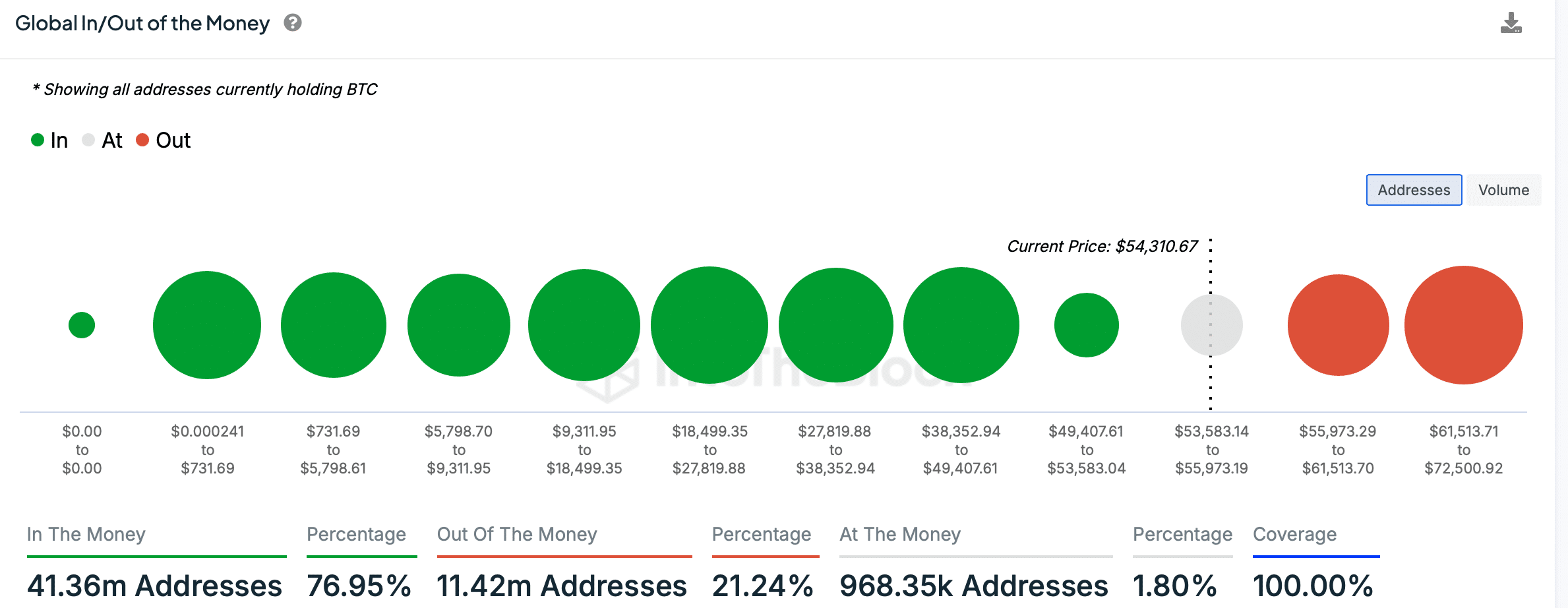

A look at IntoTheBlock’s data revealed that after the latest price correction, over 41 million BTC addresses were in profit, which accounted for 77% of the total number of Bitcoin addresses.

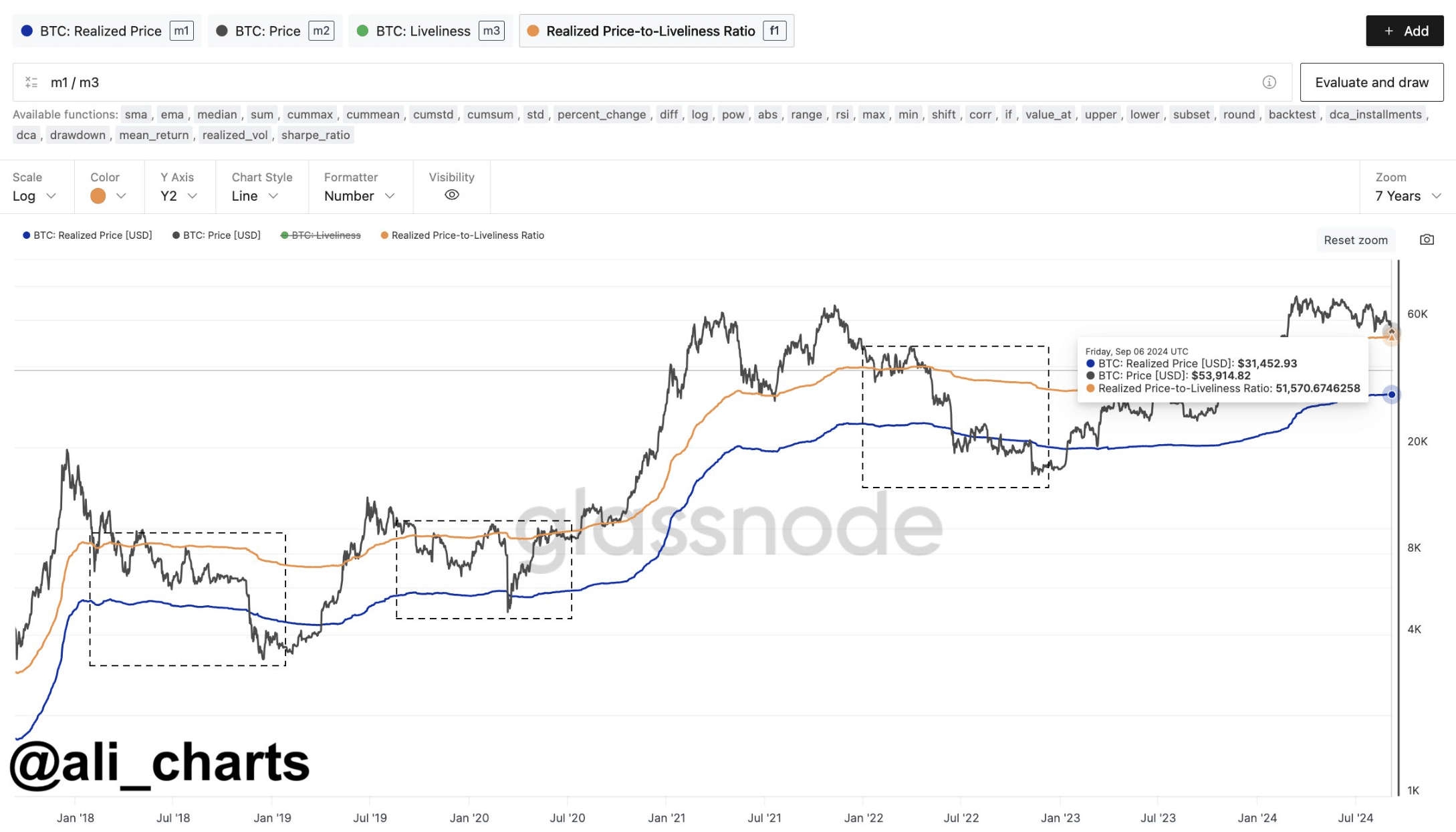

In the meantime, Ali, a popular crypto analyst, posted a tweet highlighting a notable difference. The tweet talked about the relation between BTC’s price and its realized price-to-liveliness ratio.

Historically, whenever BTC’s price falls below the realized price-to-liveliness ratio, it has led to further price declines.

To be precise, a slip under that metric pushes BTC down towards its realized price. Such incidents have happened back in 2019, 2020, and 2022.

At press time, such a bearish crossover happened. This suggested traders can expect a BTC drop to its realized price again, which at the time of writing was $31.5k.

Odds of BTC remaining bearish

Since it seemed likely for BTC to drop if history repeats, AMBCrypto checked other datasets to find out what they suggested regarding a correction.

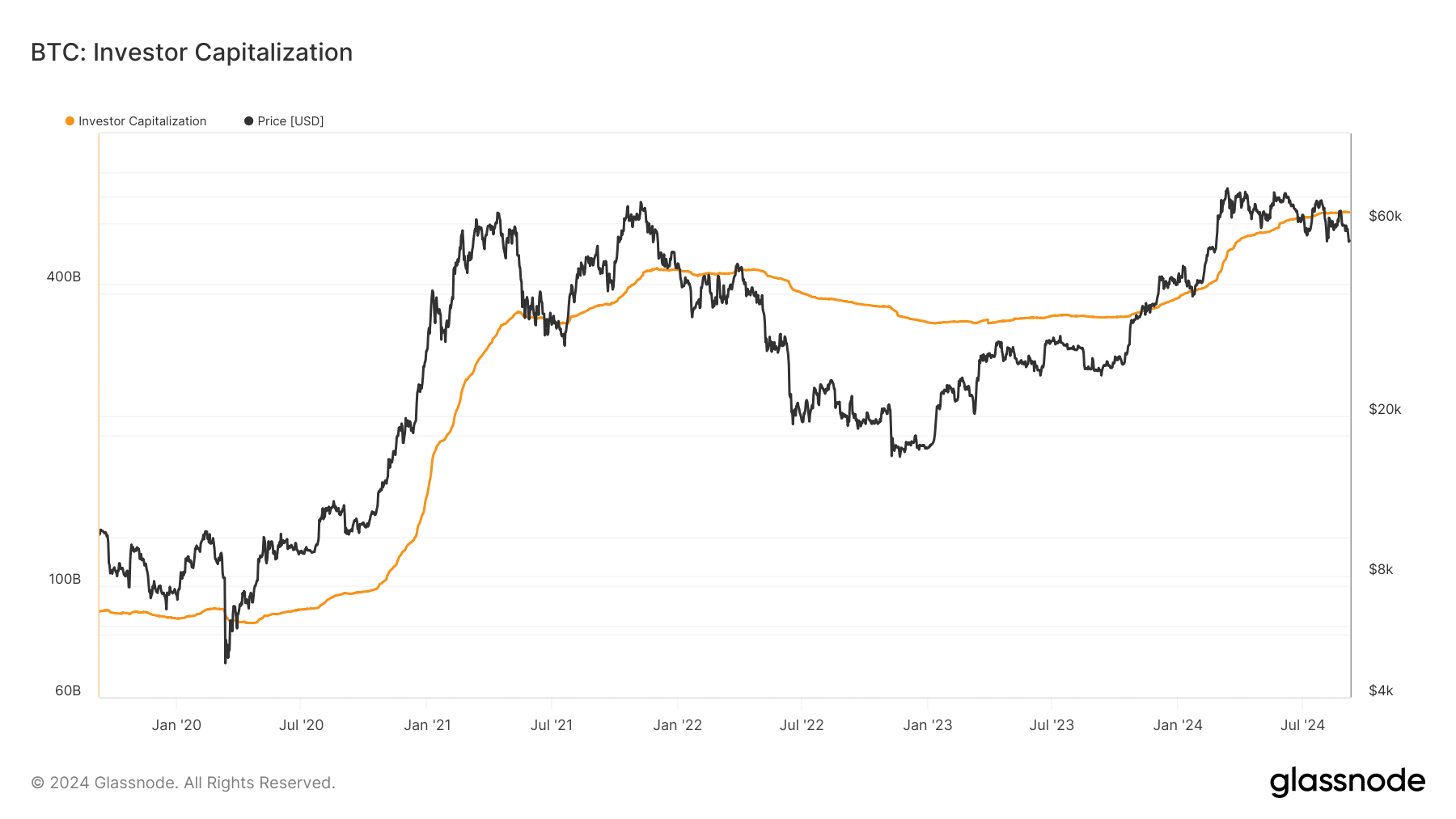

We found that BTC’s investor capitalization increased substantially. Historically, whenever BTC’s investor capitalization graph goes over its price, it is often followed by price drops.

We then took a look at CryptoQuant’s data. We found that things in the derivatives market were concerning as Bitcoin’s funding rate dropped. The coin’s taker buy sell ratio turned red, meaning that selling sentiment was dominant in the futures market.

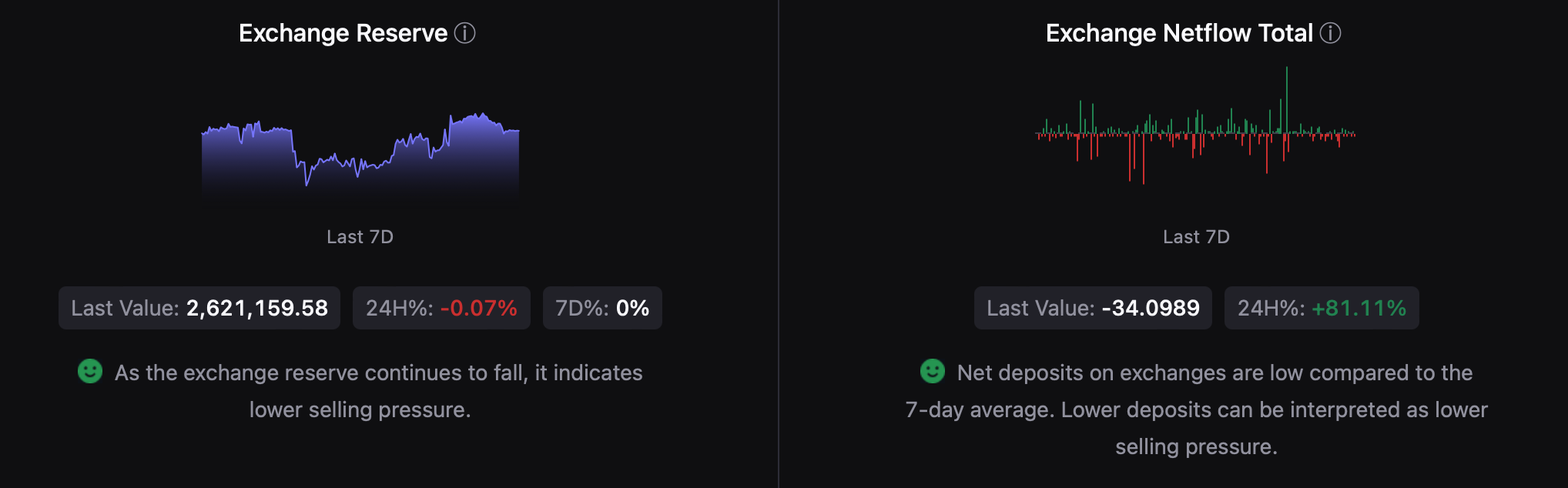

Nonetheless, investors at large were buying BTC. This was evident from its dropping exchange reserve and low net deposit on exchanges compared to the last seven day average.

As per our analysis, BTC was testing its crucial support. A slip under that would suggest that the chances of BTC following past trends and moving towards $31k are high.

The Chaikin Money Flow (CMF) registered a downtick, hinting at a failed test of BTC’s support. Nonetheless, the Relative Strength Index (RSI) remained bullish as it moved northwards.