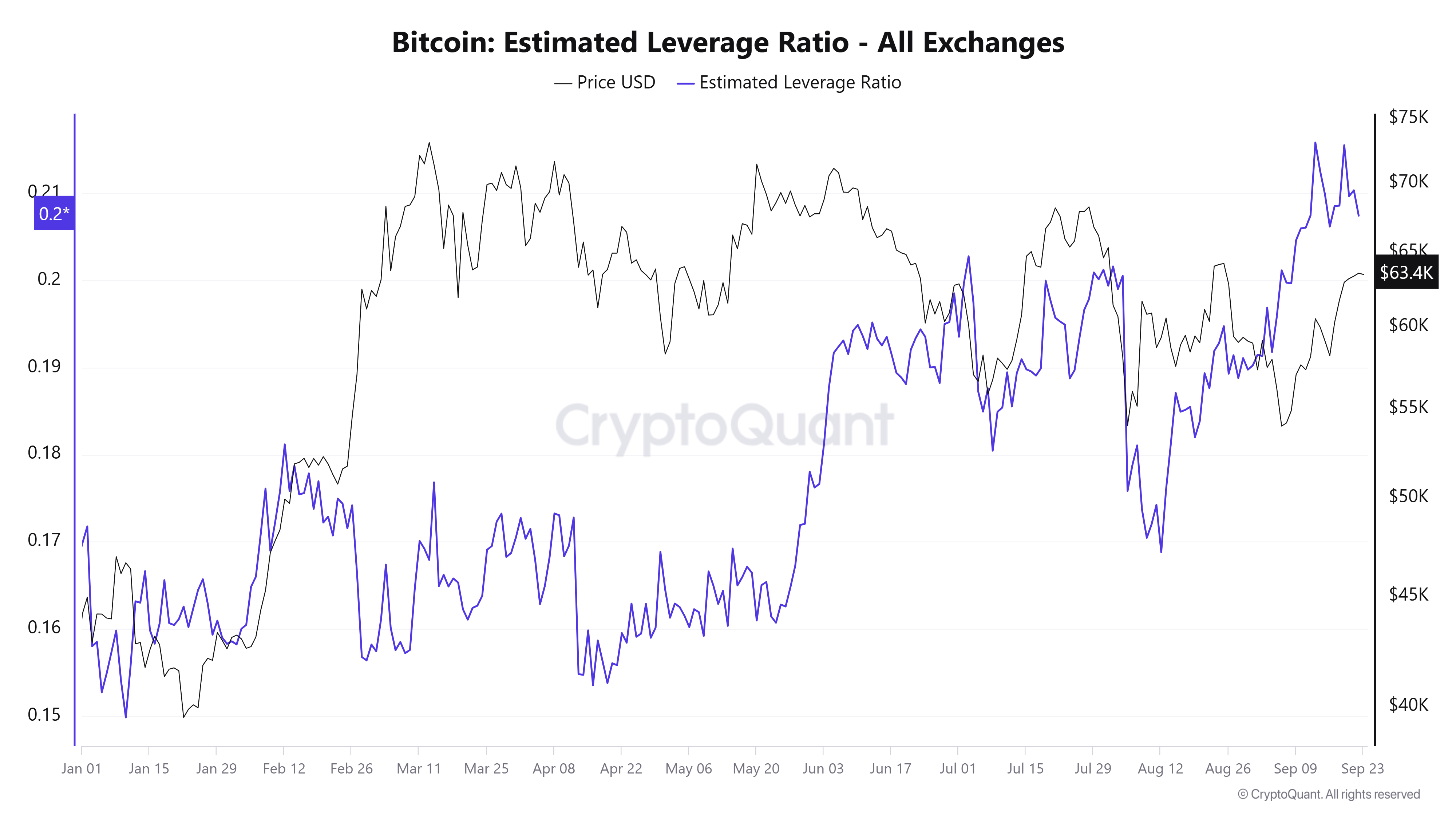

A high leverage ratio reflects growing bullish sentiment as traders increase their margin positions on BTC.

- Bitcoin could create a new all-time high in Q4 with a rally driven by multiple catalysts.

- However, profit-taking activities might continue to stifle the short-term rally.

Bitcoin [BTC] traded at $63,663 at press time after an 8% gain in the past seven days. As the last quarter of the year draws near, speculation is rife that the largest crypto could be on course to create a new all-time high.

In its weekly report, 10x Research outlined three key factors that could see Bitcoin surpass $73,000 in the coming months.

The first is the US presidential elections set for the 5th of November. This political event could spur positive momentum in the market. The report also mentions the distributions to FTX creditors as another possible catalyst to Bitcoin’s rally as the process will coincide with a bull market. The report stated,

“FTX creditors are expected to distribute $16 billion to customers between December 2024 and March 2025, with the market likely front-running this expectation. We anticipate $5-8 billion to flow back into the crypto space,”

Thirdly, MicroStrategy has raised more funds to fund its Bitcoin purchases. This raise could trigger a surge in demand for Bitcoin.

However, amid these speculations, are other macro factors and on-chain data aligning to support a bull run?

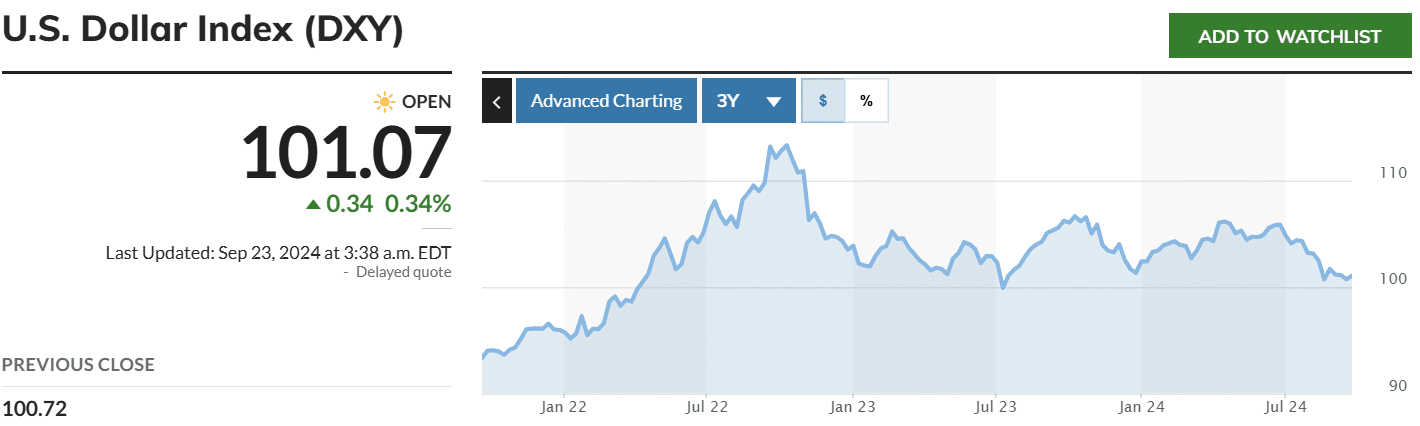

The dollar index is at range lows

The US dollar index (DXY) has been trending downwards. At press time, this index stood at 101 and has been moving at range lows of $100-$101 since August.

The DXY measures the strength of the US dollar against other top global currencies. A decline in this index signals a weakening dollar, which in turn stirs positive sentiment around Bitcoin.

Historically, whenever the DXY weakens, Bitcoin often records gains. As such, if the DXY falls under 100, Bitcoin could become attractive as an inflation hedge.

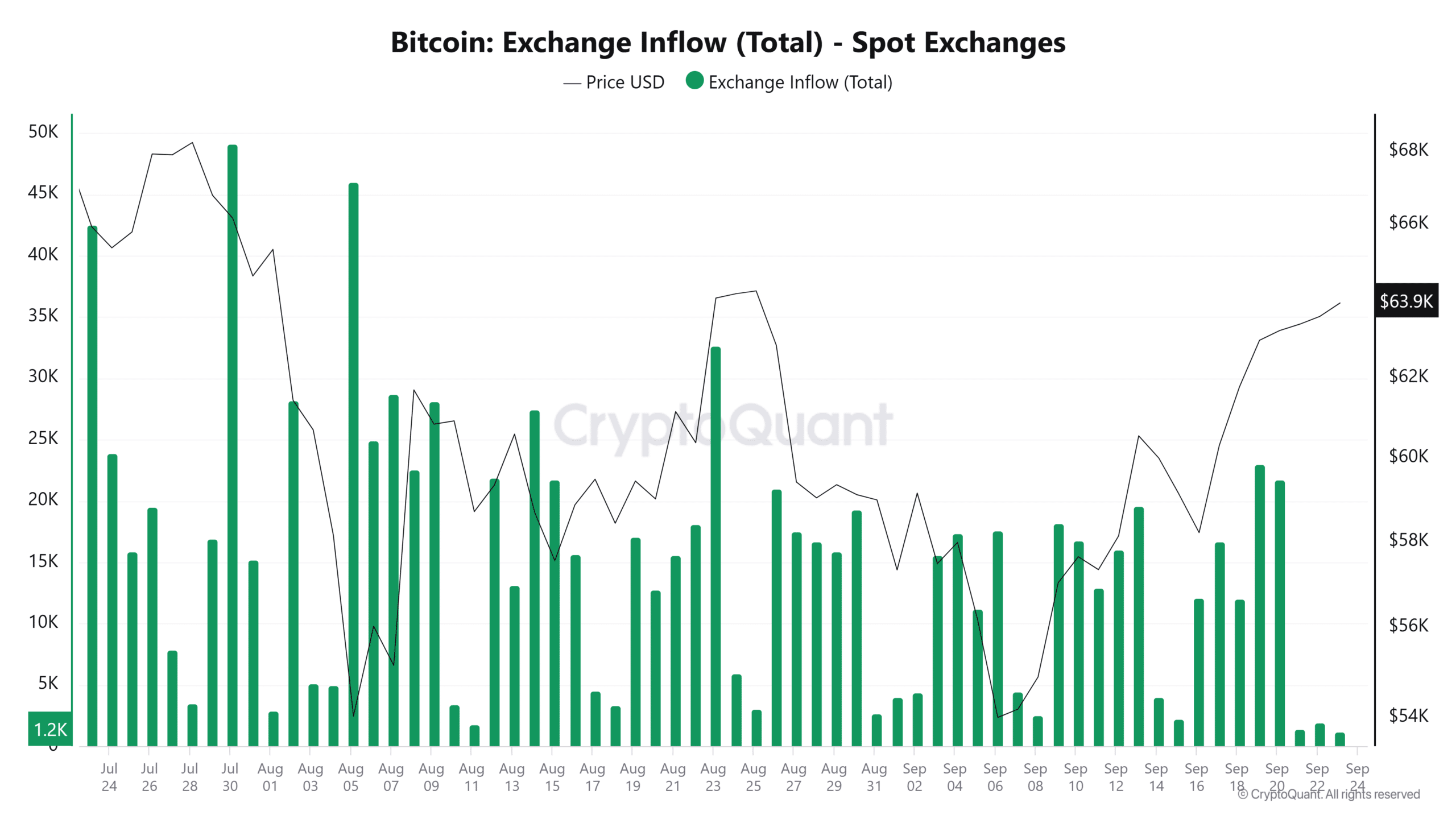

Bitcoin exchange inflows

Data from CryptoQuant shows that Bitcoin exchange inflows remained subdued over the weekend after a period of intense profit-taking.

This decline suggests that traders could be gaining confidence in Bitcoin’s rally and its ability to sustain prices above $60,000.

However, it is important to note that weekends are typically associated with low trading volumes. To confirm that profit-taking activities have slowed down, traders should watch out for the shift in flow data during the week.

Additionally, the estimated Bitcoin leverage ratio has been rising, and it currently sits at the highest level year-to-date.

A high leverage ratio usually reflects growing bullish sentiment as traders increase their margin positions on BTC. However, a rise in this metric could also point towards incoming volatility.