Last week’s Ethereum ETFs outflows resulted in weak demand this week. We explore key observations that may point to the shifting tide.

- ETH experienced weak demand amid Ethereum ETFs outflows, indicating investor disinterest.

- Open Interest tanked, but top traders went long, indicating a possible shift ahead.

Ethereum [ETH] ETFs have been experiencing continuous outflows recently, despite previously high hopes that ETFs would drive demand.

Many analysts have observed this, and some believe that this could be the reason why ETH has been bearish.

Wu Blockchain reported that Ethereum spot ETF net outflows peaked at $15.114 million on the 17th of September.

Next, Ethereum ETFs data revealed that most ETFs did not register positive flows through the week. Outflows were dominant during the week.

The Ethereum ETFs outflows may have had a heavy hand in ETH’s recent performance. The latter was consistent with the dampened sentiment, which consequently influenced low network activity.

The low investor excitement was evident in ETH’s latest price action. While Bitcoin was up over 14% from the current monthly low, ETH was only up about 7.7%.

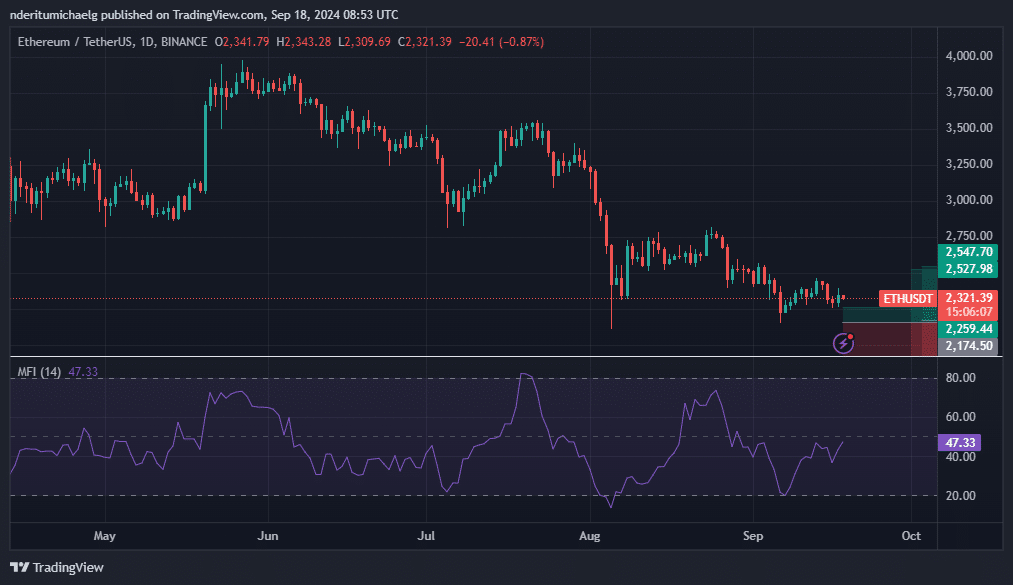

This highlighted the declining demand for ETH. The cryptocurrency traded at $2,321 at press time.

ETH’s RSI has been struggling to push above its 50% level, confirming the low bullish momentum. Despite this, its MFI shows that there is still some liquidity flowing into the coin, albeit in small volumes.

Can ETH deliver a strong comeback?

A strong rally is not entirely off the table. ETH’s current predicament is the culmination of various factors, including ETF outflows and low on-chain activity.

However, a pivot in these factors may revive robust demand, especially if Ethereum ETFs start experiencing healthy inflows.

ETH’s current price level may also be considered a healthy zone. However, it is currently full of uncertainty and this has affected its performance even in the derivatives segment.

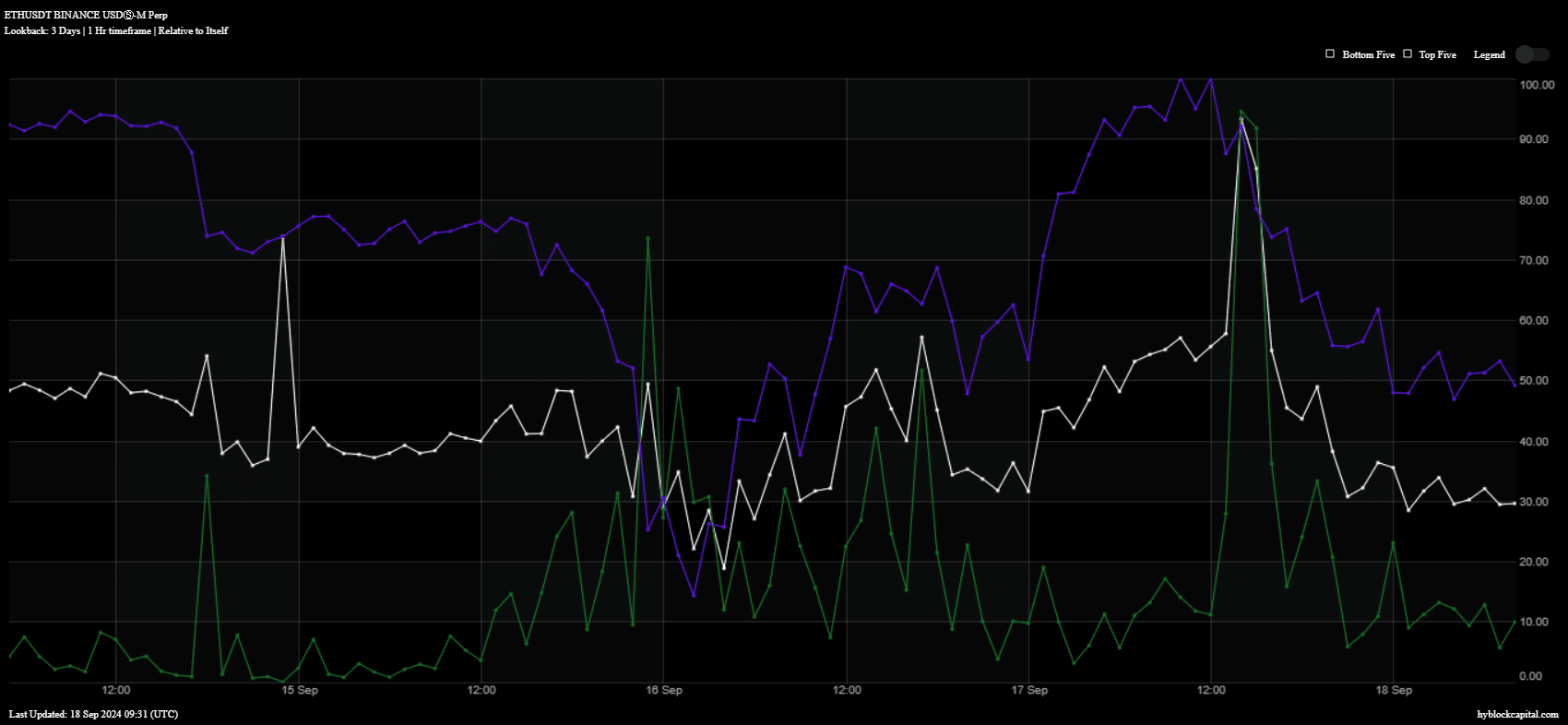

For example, the level of Open Interest (blue) tanked in the last 24 hours. We also observed a dip in buy volume (green) during the same period.

There were also signs that these outcomes in ETH’s performance may also be tied to whale manipulation. The number of longs among top traders dipped during Tuesday’s trading session.

However, it bounced back again, indicating that top traders are switching back to a bullish mood.

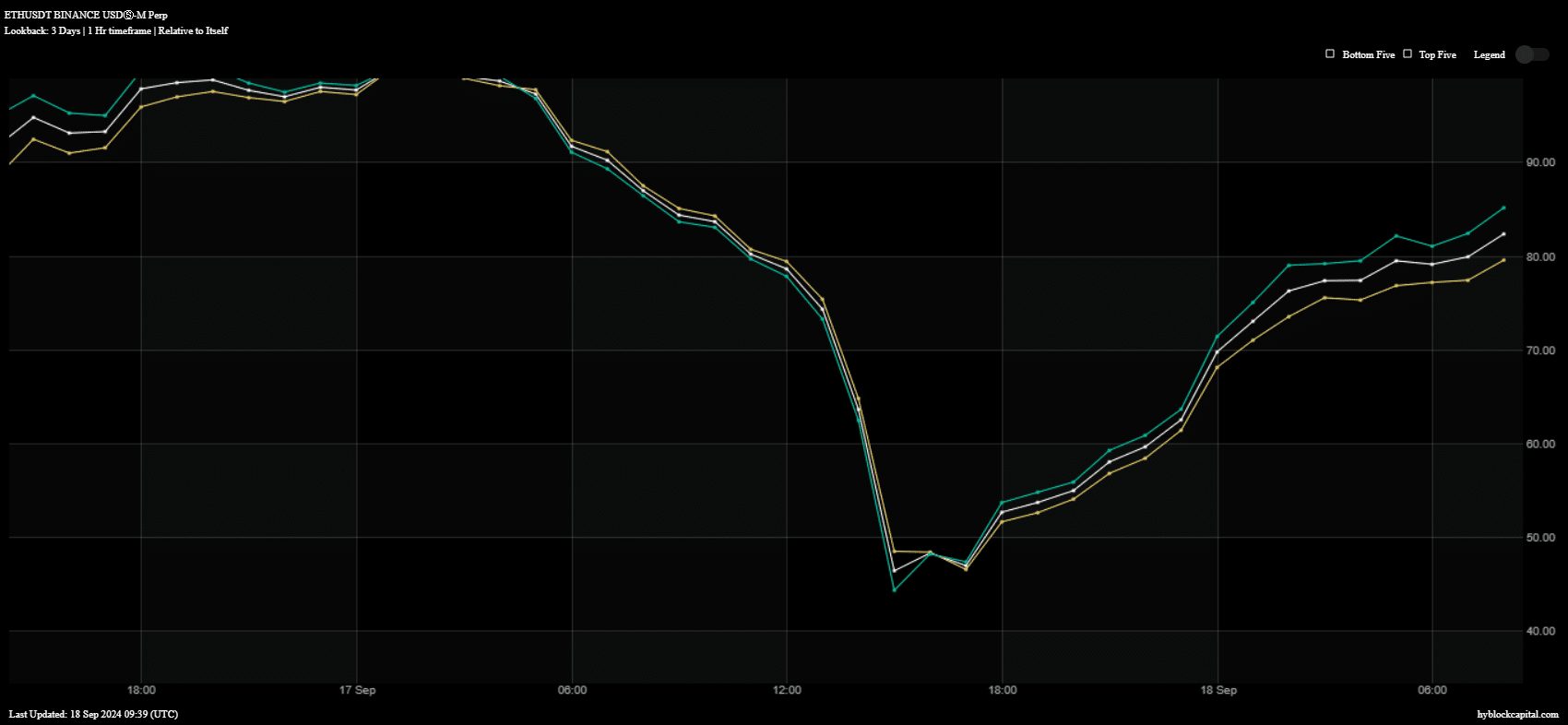

ETH longs among top addresses (green) and longs globally (yellow) bounced back considerably in the last 24 hours. This suggested that ETH bulls may flex their muscles towards the weekend.

However, this will be subject to whether ETH can sum up enough demand and momentum to push price back on an upward trajectory.