According to analysts, Bitcoin is currently facing a potential to soar to $79,000 based on chart analysis.

- Bitcoin could potentially reach $79,000 if current market conditions persist.

- Technical analysis and trading patterns suggest an imminent significant price movement for Bitcoin.

Bitcoin [BTC] remains at the forefront of many discussions and analyses. Currently, the premier cryptocurrency is trading just above the $69,000 mark, a slight rise from recent fluctuations, and has reached a 24-hour peak of $69,133.

Despite this upward trend, Bitcoin has not yet managed to surpass its March peak of over $73,000. Over the past week, the currency has seen a modest increase of 0.7%, with a more noticeable rise of 2% in the last 24 hours.

Bitcoin to $79k?

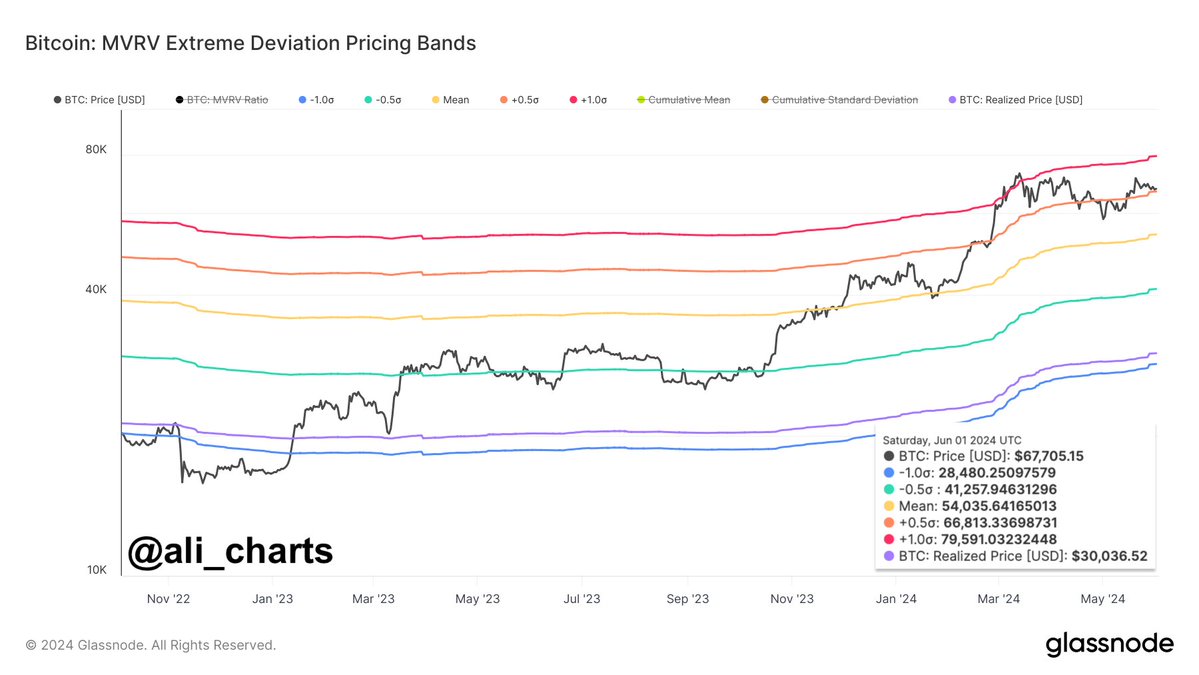

Renowned crypto analyst Ali Martinez brings a fresh perspective to Bitcoin’s future with his latest technical analysis.

Utilizing the MVRV Extreme Deviation Pricing band chart, Martinez points out that BTC is near the +0.5 Standard Deviation (σ) pricing band at $66,800.

This positioning suggests a potential rise to the 1.0σ pricing band, which could see Bitcoin escalating to around $79,600. His analysis hinges on Bitcoin’s ability to maintain its current level, setting the stage for a possible significant increase.

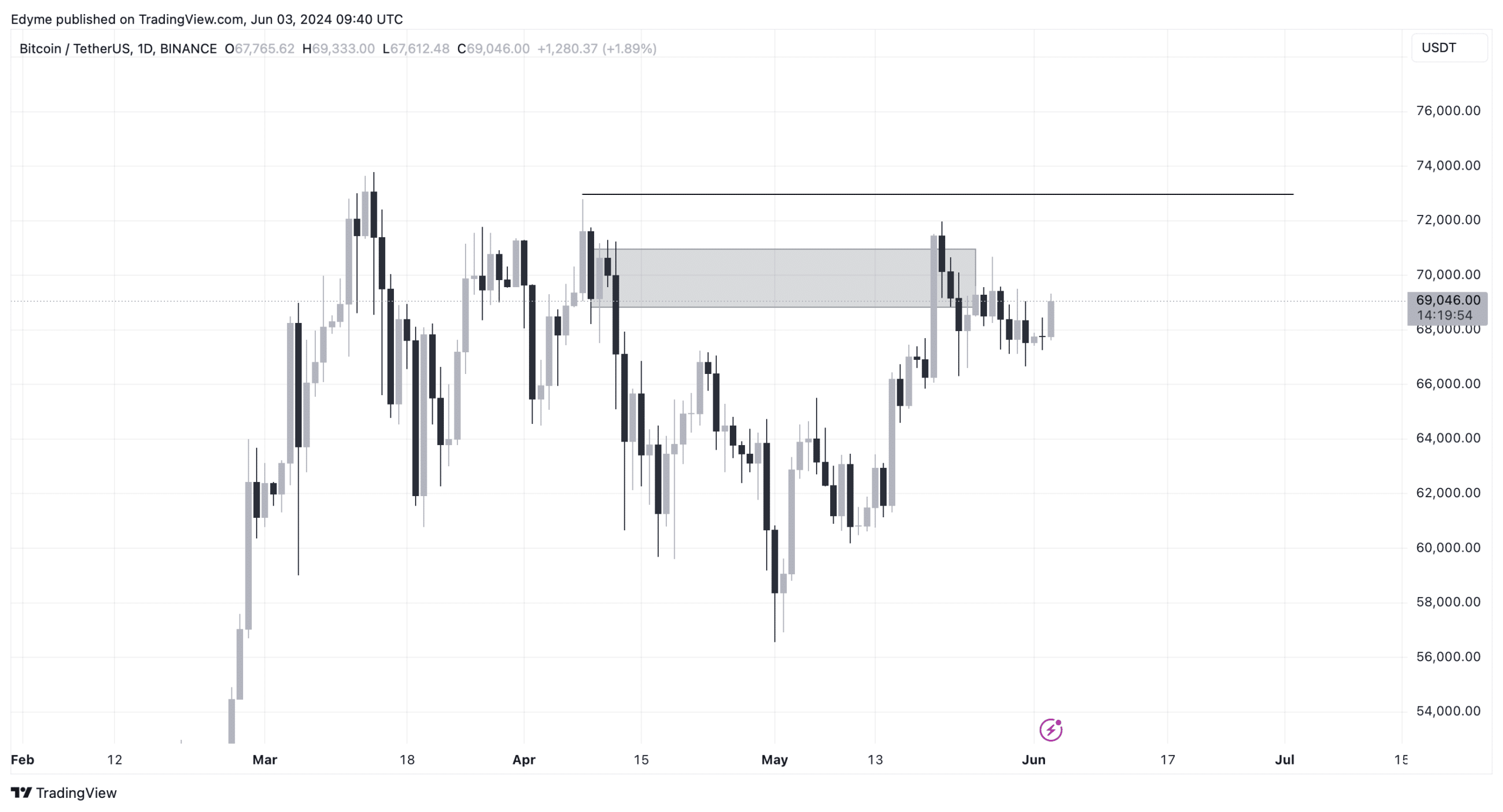

Echoing Martinez’s optimistic outlook, another prominent figure in the crypto trading community, MMCrypto, has taken to X to voice his predictions.

He posits that BTC could either climb to $74,000 or drop to $62,200, dependent on market movements in the coming days.

His predictions are accompanied by a chart illustrating a pivotal triangle pattern. According to MMCrypto, this pattern is due to resolve within 48 hours, suggesting imminent significant price movement.

Bitcoin’s future outlook

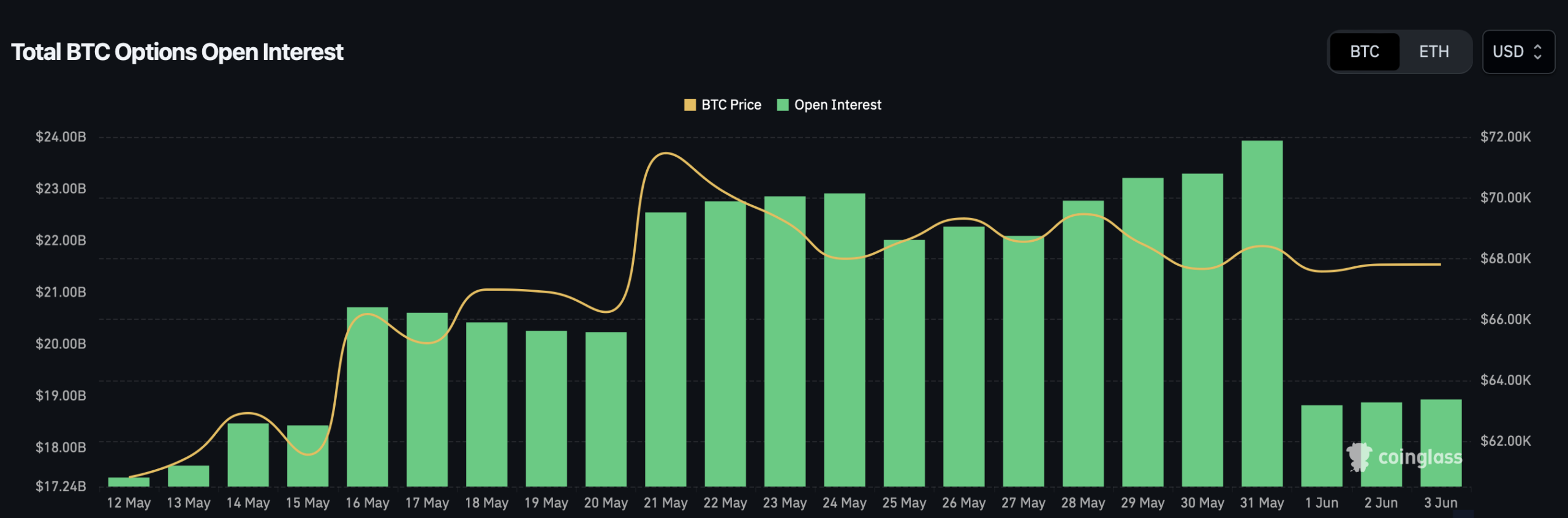

Current market data from Coinglass shows a decrease in open interest in Bitcoin, dropping from $22 billion in late May to $18 billion at press time.

This reduction in open interest, which measures the total number of unsettled contracts, could be a precursor to market stabilization or a shift in trader sentiment.

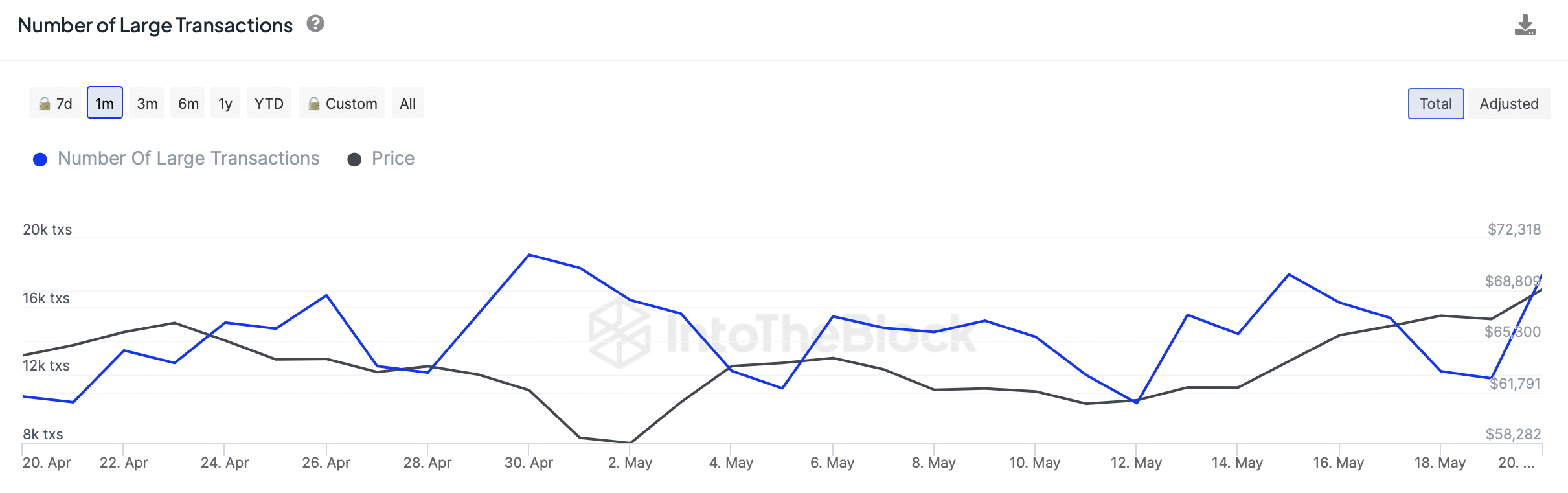

Moreover, data from IntoTheBlock indicates an increase in the number of large Bitcoin transactions, hinting at potential upward momentum as substantial market players possibly gear up for more substantial moves.

Technical analysis of BTC’s daily chart reveals that the asset has recently encountered a major supply zone after breaking downward structures.

This encounter at a critical resistance level may dictate Bitcoin’s short-term price trajectory. If Bitcoin can breach the $72,000 mark, surpassing the previous lower high, it could invalidate bearish forecasts and signal a strong bullish trend.

BTC is currently consolidating power in anticipation of an upcoming surge.

The analyst predicts a steep ascent in Bitcoin’s value, similar to patterns observed in the third and fourth quarters.