Gold advocate Peter Schiff has conducted two polls regarding bitcoin’s value and investors’ actions if the crypto’s price falls significantly. Despite his consistent criticism of bitcoin, the majority of respondents expressed strong commitment to holding their BTC even if the price drops drastically. Schiff maintains that bitcoin’s value proposition is flawed and anticipates a significant decline.

Peter Schiff Polls Bitcoin Hodlers on Price Drops

Economist and gold advocate Peter Schiff conducted a couple of polls on social media platform X about bitcoin this week.

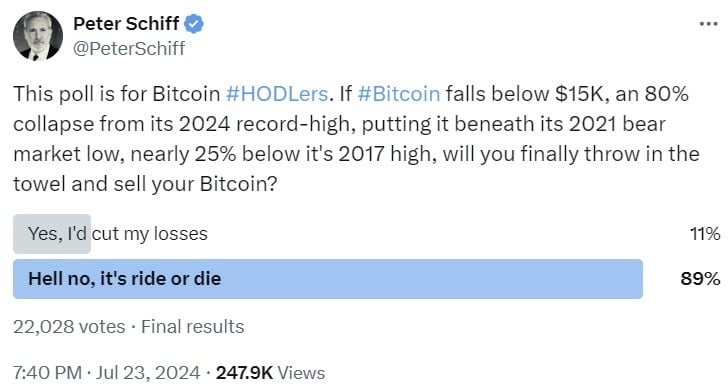

The first poll, conducted on Tuesday, asked bitcoin hodlers if they would sell their BTC if the price falls below $15,000, which he emphasized would represent an 80% drop from its 2024 record high. After 24 hours, 22,028 votes were counted, and 89% responded: “Hell no, it’s ride or die.”

On Thursday, Schiff conducted another poll, asking what bitcoin investors would do if the price drops another 80% to $3,000. He wanted to know if they would sell and admit their mistake or hold and buy more. This poll received 13,980 votes, with 90.6% indicating they would “hodl and buy more.”

Schiff has consistently criticized the value proposition of bitcoin. He also warned that BTC is in a bear market and has a long way to fall. In April, he claimed that the “bitcoin fad is over.”

The gold bug shared on X Friday: “Another big lie is that everyone who actually looks into bitcoin embraces it. That the only people who don’t own bitcoin are those who haven’t taken the time to look into it. Many smart people, myself included, took a good long look at bitcoin and just didn’t like what they saw.” In another X post, he wrote: “The worst part of bitcoin is its unfair association with concepts like sound money and limited government. When the air finally comes out of the bubble and millions are left holding the bag, bitcoin’s failure will be exploited to sell the nation on more government and CBDCs [central bank digital currencies].”