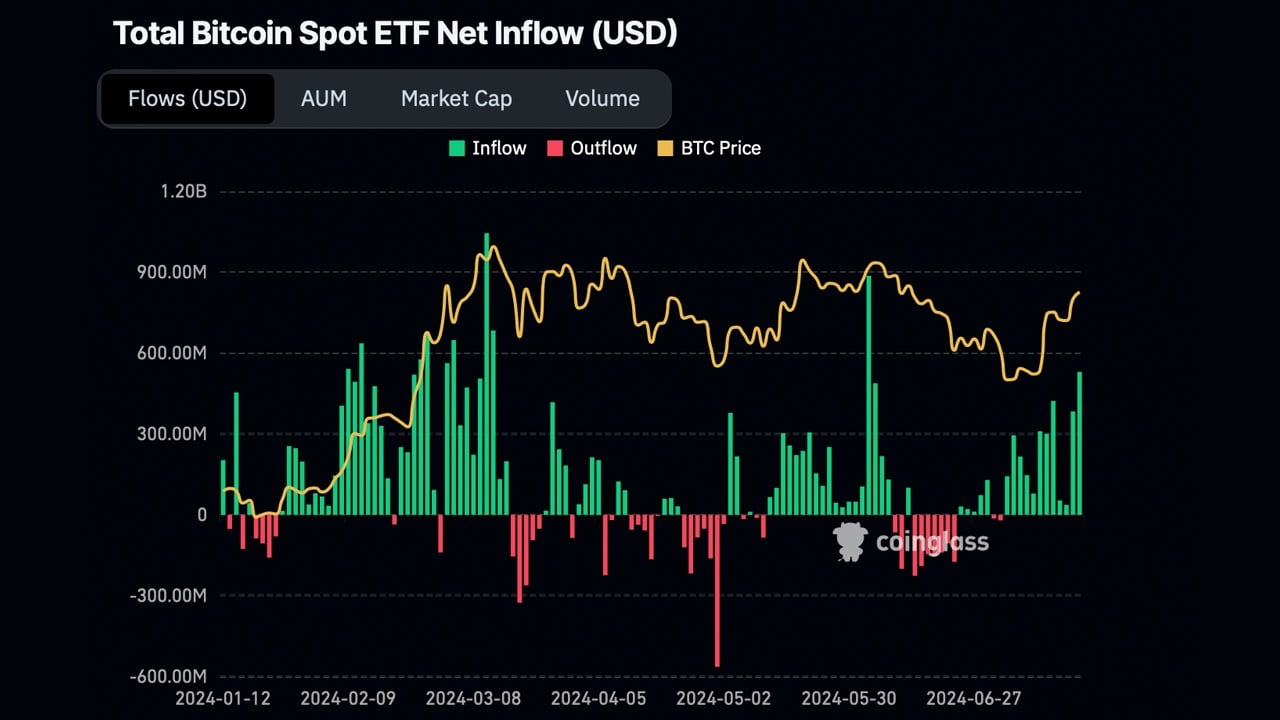

Ahead of the spot ether exchange-traded funds (ETFs) launch, U.S. spot bitcoin ETFs experienced their 12th consecutive day of inflows, accumulating $533.57 million on Monday. This influx marked the highest gains for the 11 funds since June 4.

Blackrock’s IBIT Dominates Bitcoin ETF Inflows

On Monday, U.S. spot bitcoin ETFs attracted $533.57 million, the highest single-day gain in 49 days, according to sosovalue.xyz and coinglass.com stats. Leading the pack, Blackrock‘s IBIT saw the most significant inflow, recording $526.7 million. Blackrock now holds approximately 334,943.27 BTC, valued at $22.3 billion based on current BTC rates on July 23.

Fidelity’s FBTC absorbed $23.72 million, pushing its reserves past the 180K BTC milestone. Currently, FBTC holds about 180,689.31 BTC, worth over $12 billion. Invesco’s and Galaxy’s BTCO fund saw inflows of around $13.65 million, while Franklin Templeton’s EZBC added $7.87 million on Monday.

Vaneck’s HODL was the only fund with outflows on July 22, losing $38.37 million during trading. GBTC, BITB, ARKB, BRRR, BTCW, and DEFI had neutral days with no recorded inflows or outflows. To date, the total net inflow from all 11 spot bitcoin ETFs has reached $17.59 billion.

Collectively, these funds manage $62.14 billion in net assets, representing 4.63% of BTC’s market cap. The influx of funds ahead of the spot ether ETFs launch indicates strong investor confidence in cryptocurrency ETFs.

The recent momentum in spot bitcoin ETFs reflects a broader trend of growing institutional interest in the crypto market throughout 2024. As the sector evolves, the performance of these funds will likely serve as a gauge for market sentiment and future investment opportunities.