Failure to curb the unimpressive state of the network may lead ETH’s price to $2,600.

- Data showed that ETH’s underwhelming performance has restricted money flow in the market.

- Old coins were moving, indicating that selling pressure might continue.

Ethereum [ETH] is challenged with replicating its performance in the last bull market, according to a recent report. Put together by 10x Research, the report stated that the project’s fundamentals have weakened.

As a result, Ethereum is preventing money from flowing into the market at a faster rate. For those unfamiliar, 10x Research is a crypto institutional research platform.

According to them, ETH drove the 2020/2021 bull cycle. However, the fact that the altcoin has been lagging restricts the market from reaching its full potential.

Is ETH dragging BTC and others back?

The firm also added that it expected Ethereum to drive adoption, but it has failed to do so. It does not end there. The report also mentioned that the correlation with Bitcoin [BTC] has also hindered BTC, noting that,

“Surprisingly, BTC and ETH remain highly correlated, with an R-square of 95%. Ethereum’s weak fundamentals are becoming a roadblock for Bitcoin as they prevent broad fiat inflow into the crypto ecosystem.”

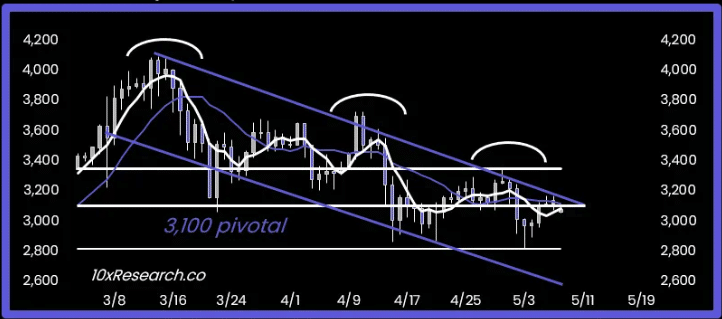

ETH’s price at press time was $3,128. And according to 10x Research, the $3,100 region was a crucial spot for the cryptocurrency.

However, the chart shared by the platform suggested that the price could decrease and hit $2,600 if care is not taken. When AMBCrypto checked the validity of this conclusion, we found some solid grounds for it.

The traction stops, places the price in danger

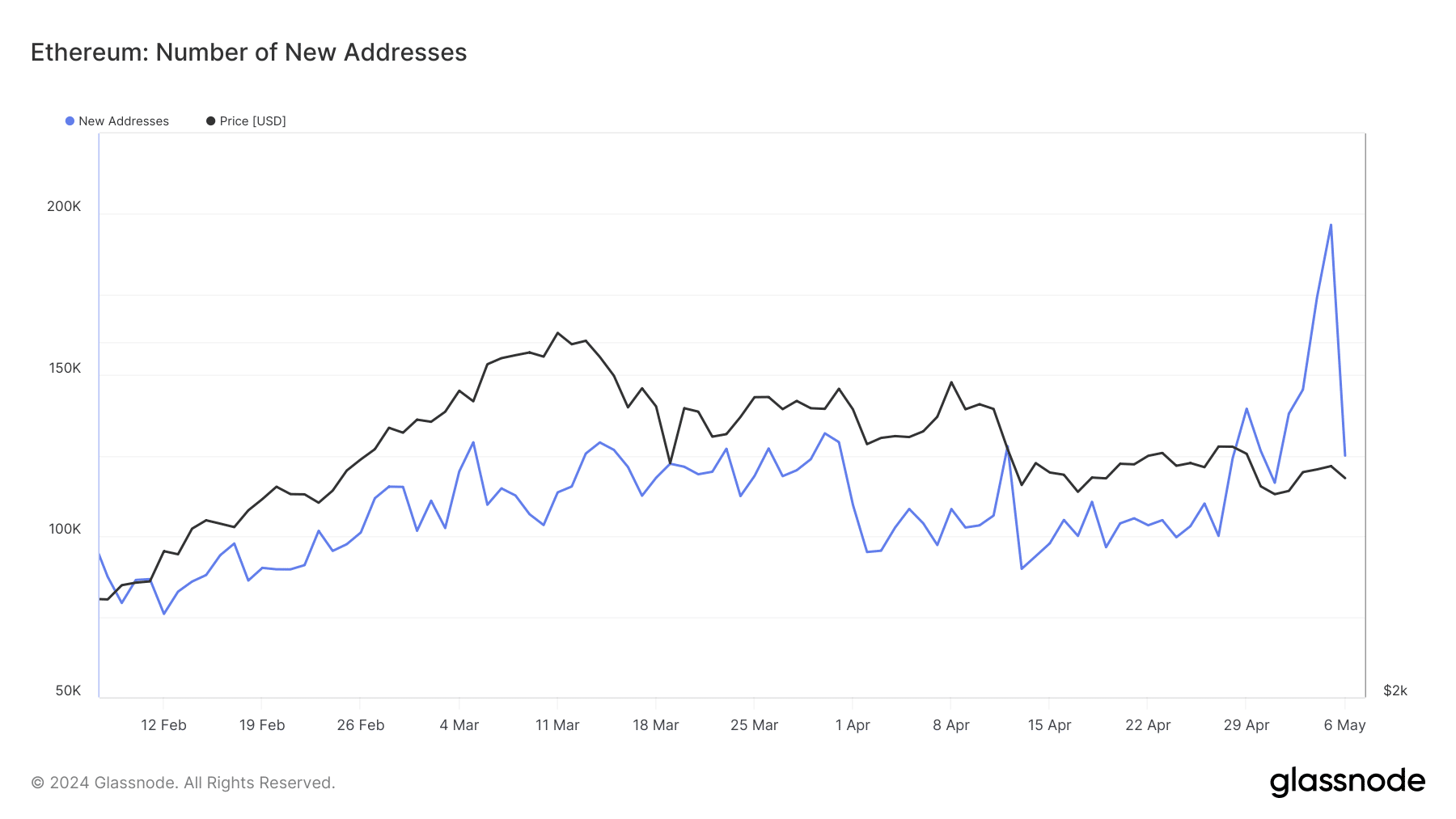

First off, we considered looking at Ethereum’s number of new addresses. According to data obtained from Glassnode, the number of Ethereum new addresses jumped to 196,620 on the 5th of May.

This metric tracks the number of unique addresses that participated in a transaction for the first time. However, at press time, that number had plunged to 125,008.

The inability to sustain this growth puts Ethereum in a dicey position. The same goes for the price of ETH.

Should the number of these addresses continue to fall, then ETH could be in a pole position for a slide below $3,100 as predicted.

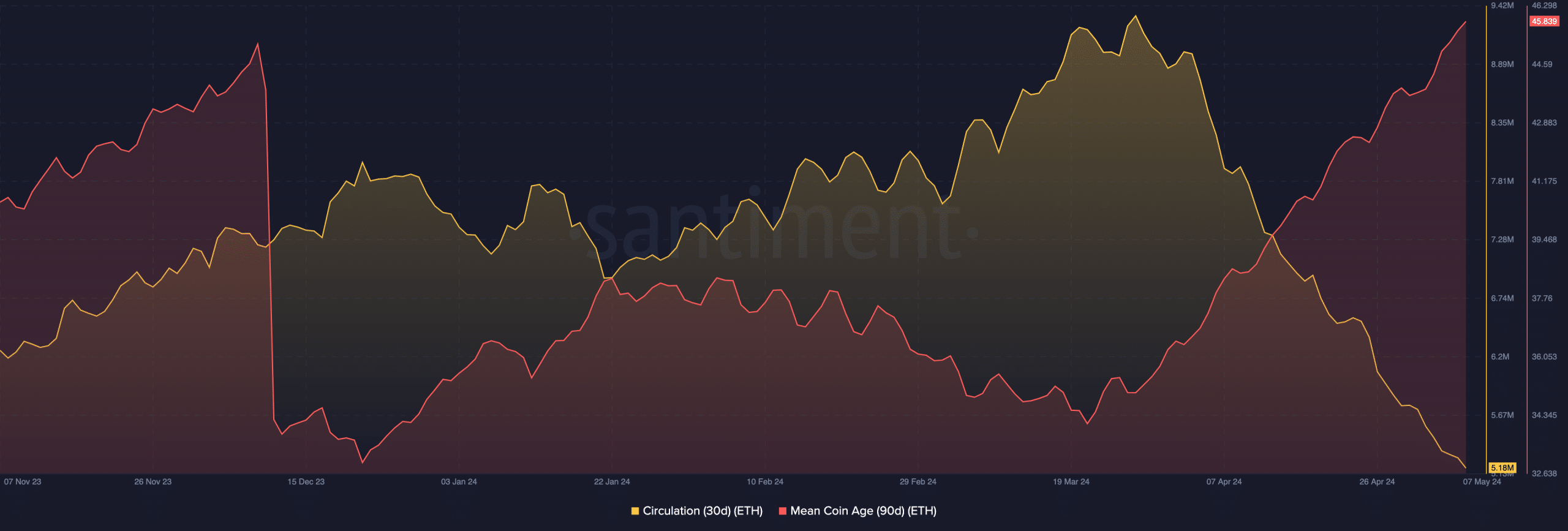

Meanwhile, ETH’s one-day circulation has been decreasing since March. This implies that fewer coins have been engaged in transactions since then.

Typically, this could be a sign of decreasing demand for the cryptocurrency. However, it also shows that the number of ETH set aside for selling could be low.

Another metric we looked at was the Mean Coin Age (MCA). Low values of the MCA indicate accumulation, and this could foreshadow higher prices in the future.

However, the 90-day MCA on Ethereum’s network skyrocketed to 45.83. This increase implies that long-term holders of the cryptocurrency are moving their coins.

Movements like this suggest a potential to sell. As such, ETH’s recovery might remain on the sidelines as the price might continue to struggle.